Sustainable Report for 2018

Operations and results in 2018

The main goals set by the Management Board with respect to production and workplace safety in 2019 are a continuation of actions taken in 2018, being the optimal utilisation of the Company’s resource base and production capacity and optimisation of copper content in ore and concentrate.

Operations and results in 2018

Production process

Production in the Group is based on the processes illustrated in the following two diagrams:

Integrated mining, processing, smelting and refining processes in KGHM Polska Miedź S.A.

Production in KGHM Polska Miedź S.A. is a fully integrated process, in which the end product of one technological phase is the starting material (half-finished product) used in the next phase. Mining in KGHM Polska Miedź S.A. is performed by three mining Divisions: Lubin, Rudna and Polkowice-Sieroszowice. In the subsequent phase the Concentrators Division prepares concentrate for the smelters and refineries, while the Tailings Division is responsible for storing and managing the tailings generated by the copper ore enrichment process. The organisational structure of KGHM includes two metallurgical facilities: the Legnica Copper Smelter and Refinery and the Głogów Copper Smelter and Refinery, as well as the Cedynia copper wire rod plant.

Mining

The technology of mining the copper ore in all 3 mines is based on the room-and-pillar system with the use of blasting technology for ore extraction. This involves access and preparatory work, comprised of the excavation of a drift network on all sides of the site to be mined, cutting of the unmined rock mass with rooms and drifts separating a number of operating pillars, as well as extraction of the ore followed by the transport of the ore to underground dumping stations, where the large rocks are crushed and sifted through a grate, and then the crushed muck is transported to the storage areas near the shafts, from which it is transported to the surface by skip hoisting shafts.

The work related to mining of the copper ore is fully mechanised, in a 4-shift labour system, with the use of motorised mining rigs, most of which are equipped with air-conditioned cabins and systems supporting the work of the operators. Mining work is conducted in the following cycle: drilling the blasting holes with the support of motorised drilling rigs, loading blasting material into drilled holes by drilling rigs, group blasting in mining divisions, followed by the ventilation of the areas blasted (from 30 minutes to 2 hours; in seismically-sensitive areas this time is longer). The next stage involves the loading of the muck using motorised loaders into haulage vehicles and its transport to dumping stations, along with protection of the exposed face by roof anchor bolts using bolting rigs. The crushed muck is transported by conveyor belts or mine rail trolleys to the storage sites near the shafts, and is then transported to the surface. After the muck is unloaded at the shaft top, it is transported by conveyor belts or railway to the ore concentrators located at each of the three mines.

The operations and processes applied at each of the three ore concentrators are the same. However, due to the varied lithological and mineralogical composition of the ore from individual mines, the production layout of each facility differs. The enrichment technologies applied include the following individual operations: screening and crushing, milling and classification, flotation and drying of the concentrate.

The flotation process results in concentrate with an average copper content of approx. 22-23%, and flotation waste. The Rudna mine concentrator produces concentrate with the highest copper content (approx. 26%), while the lowest is at the Lubin mine concentrator (approx. 13%). The Polkowice mine concentrator produces concentrate of approx. 25% copper content.

The dried concentrate of approx. 8.5% water content is transported by rail to the following smelter/refineries: the Legnica Copper Smelter and Refinery located in Legnica, the Głogów I Copper Smelter and Refinery and the Głogów II Copper Smelter and Refinery, located in Głogów.

The flotation waste, in the form of slimes, are transported through pipelines to the Żelazny Most Tailings Storage Facility, where the sedimentation of the solid particles takes place and the clarified water is collected and redirected to the ore concentrators. The storage site also serves as a retention-dosage reservoir for excess mine water. Excess water is hydrotechnically discharged (periodically) to the Odra River. This method was developed and implemented in partnership with research institutions, and it has been officially approved for use under the provisions of the Water Law. Studies demonstrate that the discharging of mine and process water to the Odra River cannot result in any changes that would make the proper functioning of water ecosystems impossible or prevent conformance with the applicable water quality requirements.

Metallurgy

The copper smelters/refineries produce electrolytic copper from own concentrates as well as from purchased metal-bearing material (copper concentrates, copper scrap, blister copper). The Legnica Copper Smelter and Refinery uses a multi-stage process whose main stages include: preparation of the charge material, its reduction smelting in shaft furnaces to the form of matte copper, conversion to the form of blister copper with approx. 98.5% Cu content; fire refining in anode furnaces to produce anodes of 99.2% Cu content; and electrorefining. The final product is electrolytic copper cathodes with 99.99% Cu content.

The Głogów Copper Smelter and Refinery applies one-stage flash furnace technology based on a license from the Finnish company Outokumpu. The dried concentrate, with a moisture content of 0.3% H2O, is smelted in a flash furnace into blister copper containing around 98.6% Cu, which is subject to fire refining in anode furnaces. The slag, which still contains on approximately 14% copper, is sent to an electric furnace, where the copper is removed while the CuPbFe alloy obtained is sent to the convertors, from which the resulting copper is sent for refining in anode furnaces. The copper anodes produced from fire refining are then sent for electrorefining, and the end product is electrolytic copper in the form of cathodes containing 99.99% Cu.

Approx. 45% of the electrolytic copper produced by KGHM’s smelters and refineries are further processed in the Cedynia Copper Wire Rod Division, where copper wire rod is produced by a continuous smelting, casting and rolling process as well as oxygen-free copper rod and oxygen-free, low-alloy, silver-bearing copper rod based on UPCAST technology are produced.

The anode slime produced during the electrorefining process at KGHM’s smelters and refineries contains precious metals, and is the raw material used by the Precious Metals Plant at the Głogów Copper Smelter and Refinery to produce the following products: refined silver, gold, palladium-platinum concentrate and selenium. The electrolyte in the Tank Hall, once the copper is removed, is used to produce crude nickel sulphate.

The lead-bearing dust and slimes collected as a result of the removal of dust from technological exhaust gases at the smelters and refineries are smelted, together with decopperised convertor slag from the flash furnace production line, in Dörschel furnaces at the Lead Section of the Głogów Copper Smelter and Refinery into crude lead containing 99.3% Pb. This crude lead is then refined at the Legnica Copper Smelter and Refinery to obtain the end product - refined lead containing 99.85 % Pb.

The segment KGHM INTERNATIONAL LTD.

The core business of the KGHM INTERNATIONAL LTD. Group of companies is the mined production of metals, such as copper, nickel, gold, platinum and palladium, from both open-pit and underground mines, as well as advancement of mining and exploration projects. The following drawing shows a simplified flowchart of core business of the KGHM INTERNATIONAL LTD. Group.

Simplified flowchart of core business of the KGHM INTERNATIONAL LTD. Group.

Operations and results in 2018

Primary Group products

Copper cathodes

Copper cathodes made from electrolytic copper with a minimum copper content of 99.99% are the basic product of KGHM Polska Miedź S.A. They meet the highest quality requirements and are registered as Grade „A” on the London Metal Exchange (LME) under three brands: HMG-S, HMG-B and HML and on the Futures Contracts Exchange in Shanghai. Copper cathodes are also the primary product of the Carlota mine in the USA and the Franke mine in Chile, both part of the KGHM INTERNATIONAL LTD. Group. The main customers for the cathodes are producers of wire rod, other rods, flat bars, pipes, sheets and conveyor belts.

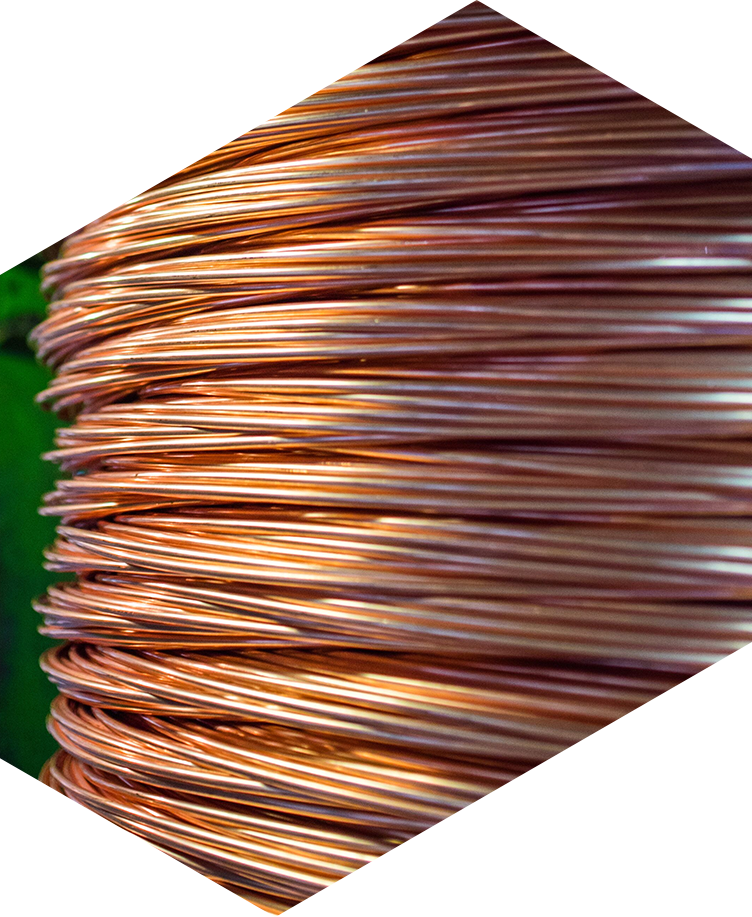

Copper wire rod

The second copper product, in terms of volume, produced by KGHM Polska Miedź S.A. is 8 mm copper wire rod manufactured through the Contirod® continuous process of melting, casting and drawing. Depending on the needs of the customer, wire rod is produced in various classes of quality. The main customers for wire rod are the cable, electrical goods and electrotechnical industries.

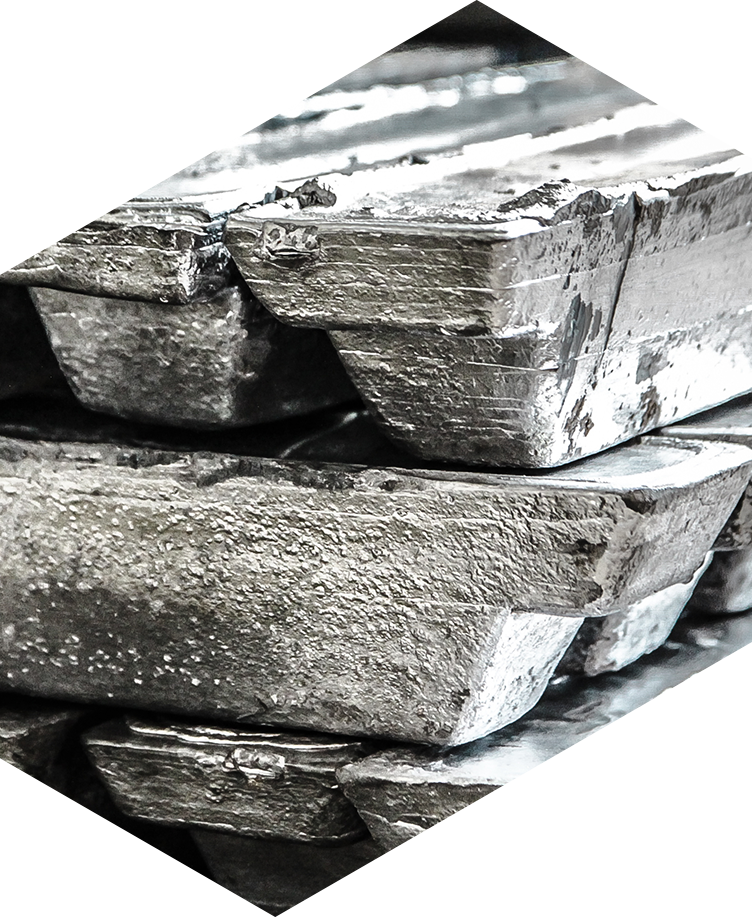

Silver

Electrolytic silver is produced mainly by KGHM Polska Miedź S.A. in the form of bars (ingots, billets) and grains containing 99.99% silver. Silver bars (weighing approx. 32 kg) hold a certificate registered on NYMEX in New York as well as a Good Delivery certificate issued by the London Bullion Market Association. Granule silver is packed in bags weighing 25 kg or 500 kg. The main customers for silver are financial institutions, the jewellery industry, photographic industry, and the electronics and electrical industries as well as producers of coins and medallions.

Copper concentrate

Produced by the Robinson mine in the USA, part of the KGHM INTERNATIONAL LTD. Group, containing over 20% of copper. This product is also produced by the Sierra Gorda mine in Chile (copper content is above 20%). Both of these concentrates also include gold as an additional product. The copper concentrates are sold for further processing as a commodity product. Occasionally KGHM Polska Miedź S.A. also sells copper concentrate produced by the Lubin, Rudna and Polkowice-Sieroszowice mines (average copper content, depending on the type of concentrate, is from approx. 13% to approx. 25%).

Molybdenum concentrate

Another commercial product (apart from copper concentrate) produced by the Robinson mine in the USA, part of the KGHM INTERNATIONAL LTD. Group. Production of molybdenum concentrate is derivative from the process of copper concentrate production.

Molybdenum oxides

One of the main commercial products of Sierra Gorda is molybdenum oxide, arising from the processing of the molybdenum sulphide concentrate (containing approx. 48% Mo) produced by the Sierra Gorda mine. Molybdenum is used in the aircraft, defense, oil, nuclear and electronics industries.

Gold

Gold in the form of bars weighing approximately 0.5 kg, 1 kg, 4 kg, 6 kg and 12 kg containing 99.99% gold is produced by KGHM Polska Miedź S.A. Gold is used in the jewellery industry, by banks and in the electrical industry.

Ore containing copper, nickel and TPM (precious metals – gold, platinum, palladium)

Produced by the mines in the Sudbury Basin in Canada, part of the KGHM INTERNATIONAL LTD. Group. The ore containing copper, nickel and TPM is sold for further processing to a smelter and refinery in the Sudbury Basin.

Oxygen-free copper rod

Two types of rod are produced: Cu-OFE oxygen-free rod and CuAg(OF) oxygen-free, silver-bearing rod. Rod is produced using UPCAST® technology, in diameters from 8 mm to 25 mm (8 mm, 12.7 mm, 16 mm, 20 mm, 22 mm, 24 mm and 25 mm). Customers for this product are in the cable industry, with application in the form of thin wires, enamelled wires and fire-resistant cables, as well as cables for transmitting audio and video signals. In addition, oxygen-free, silver-bearing rod is used in the manufacture of trolleys and commutators.

Round copper billets

Round copper billets produced from copper cathodes cast in the classification Cu-ETP1 and Cu-ETP, and from oxygen-free phosphorus-containing copper cathodes in the classification Cu-HCP, Cu-PHC, Cu-DLP and Cu-DHP are used in the construction industry (to manufacture pipes) and the electrotechnical industry (to manufacture belts, rods and profiles).

Refined lead

Refined lead in the form of bars (dimensions: 615 x 95 x 80 mm) has been produced by KGHM Polska Miedź S.A. since 2007. It has been registered on the London Metal Exchange since 2014 under the brand „KGHM”. Refined lead is mainly used to produce batteries and lead oxides.

Operations and results in 2018

Main production goals

The main goals set by the Management Board in terms of production and occupational health and safety for 2019 are a continuation of actions taken in 2018, i.e.:

- optimal utilisation of the resource base and of the production capacity of the Company, and

- optimisation of Cu content in ore and concentrate.

Key tasks in 2019:

| in mining |

|

| in ore processing |

|

| in metallurgy |

|

| in occupational health and safety |

|

Mine production

In 2018 extraction of ore (dry weight) amounted to 30.3 million tonnes, which was 0.9 million tonnes less than in 2017.

Average copper content in extracted ore amounted to 1.49% and was lower than the level achieved in 2017 due to mining in regions with a lower copper ore content. In the case of silver in ore, content was higher and amounted to 48.6 g/t.

As a result the amount of copper in extracted ore was lower than in 2017 by 14.8 thousand tonnes of Cu and amounted to 452.0 thousand tonnes. The volume of silver in ore decreased by 18 tonnes and amounted to 1 471 tonnes.

In 2018, 30.3 million tonnes of ore (dry weight) were processed (or 1 247 thousand tonnes less than in 2017). The lower amount of ore extracted by the mines directly affected the amount of copper in concentrate, which amounted to 401.3 thousand tonnes.

The production of concentrate (dry weight) decreased as compared to 2017 by 72 thousand tonnes (a decrease from

1 833 thousand tonnes to 1 761 thousand tonnes).

The amount of silver in concentrate was lower than the amount produced in 2017 by 2%.

| Unit | 2017 | 2018 | Change (%) | 4Q'18 | 3Q'18 | 2Q'18 | 1Q'18 | |

|---|---|---|---|---|---|---|---|---|

| Mined ore (wet weight) | mn t | 32.8 | 31.8 | (3.0) | 7.6 | 8.1 | 8.0 | 8.1 |

| Mined ore (dry weight) | mn t | 31.2 | 30.3 | (2.9) | 7.3 | 7.7 | 7.6 | 7.7 |

| Copper grade | % | 1.50 | 1.49 | (0.7) | 1.47 | 1.49 | 1.52 | 1.50 |

| Copper in ore | kt | 466.8 | 452.0 | (3.2) | 106.6 | 114.2 | 114.8 | 116.4 |

| Silver grade | g/t | 47.8 | 48.6 | +1.7 | 48.4 | 48.9 | 48.7 | 48.5 |

| Silver in ore | t | 1 489.7 | 1 471.4 | (1.2) | 351.8 | 375.3 | 368.8 | 375.4 |

| Production of concentrate (dry weight) | kt | 1 833 | 1 761 | (3,9) | 423 | 442 | 448 | 447 |

| Copper in concentrate | kt | 419.3 | 401.3 | (4.3) | 95.3 | 101.0 | 102.3 | 102.7 |

| Silver in concentrate | t | 1 289.9 | 1 264.3 | (2.0) | 304.0 | 320.8 | 317.7 | 321.8 |

Metallurgical production

The production of electrolytic copper as compared to 2017 decreased by 20.2 thousand tonnes, or by 3.9%. The lower production of electrolytic copper was due to the maintenance shutdown of the concentrate smelting installation at the Głogów II Copper Smelter and Refinery, which lasted from 8 April to 25 June. Production re-commenced 8 days sooner than projected by the initial schedules. By supplementing own concentrate with purchased metal-bearing materials in the form of scrap, copper blister and imported concentrate, existing technological capacity was effectively used.

The production of other metallurgical products (silver, wire rod, OFE rod and round billets) derives from the level of electrolytic copper production and depends on the type of raw material used, and above all on market demand.

In comparison to 2017, the production of metallic gold decreased by 1 061 kg, or 29%, and metallic silver production was lower by 29 tonnes, closing the year at 1 189 tonnes.

Metallurgical production of KGHM Polska Miedź S.A.

| Unit | 2017 | 2018 | Change (%) | 4Q'18 | 3Q'18 | 2Q'18 | 1Q'18 | |

|---|---|---|---|---|---|---|---|---|

| Electrolytic copper, including: | kt | 522.0 | 501.8 | (3.9) | 135.4 | 138.9 | 116.7 | 110.8 |

| kt | 358.9 | 385.3 | +7.4 | 103.6 | 110.4 | 85.3 | 86.0 |

| kt | 148.0 | 116.5 | (21.3) | 31.8 | 28.5 | 31.4 | 24.8 |

| kt | 15.1 | - | × | - | - | - | - |

| Wire rod, OFE and CuAg rod | kt | 257.9 | 266.4 | +3.3 | 62.3 | 72.0 | 65.9 | 66.2 |

| Round billets | kt | 13.7 | 15.8 | +15.3 | 3.7 | 3.9 | 4.3 | 3.9 |

| Metallic silver | t | 1 218.0 | 1 188.8 | (2.4) | 352.6 | 357.8 | 239.1 | 239.3 |

| Metallic gold | koz t | 117.3 | 83.2 | (29.1) | 21.1 | 23.7 | 20.1 | 18.3 |

| Refined lead | kt | 30.0 | 30.1 | +0.3 | 8.2 | 6.9 | 7.6 | 7.5 |

Main production goals

The main goals set by the Management Board in terms of production and occupational health and safety for 2019 are a continuation of actions taken in 2018, i.e.:

- optimal utilisation of the resource base and of the production capacity of the Company, and

- optimisation of Cu content in ore and concentrate.

| in mining |

|

| in ore processing |

|

| in metallurgy |

|

| in occupational health and safety |

|

Operations and results in 2018

Sales

In 2018, the sales volume of copper and copper products produced by KGHM Polska Miedź S.A. amounted to 514.4 thousand tonnes and was comparable to the sales volume in 2017 (+2%), although in 2018 there were sales of copper concentrate in the amount of 149.5 thousand tonnes dry weight (of which 22.3 thousand tonnes was Cu). There was however a decrease in the volume of cathodes sold by 19.2 thousand tonnes (-8%). Sales of copper wire rod increased by 2.8 thousand tonnes (+1%) and OFE rod by 2.1 thousand tonnes (+16%).

Sales of metallic silver in KGHM Polska Miedź S.A. in 2018 amounted to 1 147 tonnes and were lower than the level of sales in 2017 by 38 tonnes (-3%). In 2018 there also occurred the sale of silver in concentrate (81 tonnes).

The volume of gold sales in 2018 amounted to 83.8 thousand troy ounces, or a decrease by 28% as compared to 2017 (117.1 thousand troy ounces).

Sales volume of basic products of KGHM Polska Miedź S.A.

| Unit | 2017 | 2018 | Change (%) | 4Q'18 | 3Q'18 | 2Q'18 | 1Q'18 | |

|---|---|---|---|---|---|---|---|---|

| Cathodes and cathode parts | kt | 233.5 | 214.3 | (8.2) | 74.1 | 58.4 | 47.3 | 34.5 |

| kt | 259.9 | 264.6 | +1.8 | 66.4 | 68.3 | 65.2 | 64.7 |

| kt | (0.3) | 22.3 | × | 4.2 | 6.8 | 11.3 | - |

| kt | 12.9 | 13.2 | +2.3 | 3.0 | 3.6 | 3.3 | 3.3 |

| Total copper and copper products | kt | 506.0 | 514.4 | +1.7 | 147.7 | 137.1 | 127.1 | 102.5 |

| Metallic silver | t | 1 185.0 | 1 146.8 | (3.2) | 344.8 | 349.9 | 245.0 | 207.0 |

| Payable silver in concentrate | t | - | 80.6 | × | 13.5 | 33.2 | 33.8 | - |

| Metallic gold | koz t | 117.1 | 83.8 | (28.4) | 21.9 | 22.7 | 18.9 | 20.3 |

| Refined lead | kt | 29.6 | 30.5 | +3.0 | 8.6 | 7.8 | 6.7 | 7.4 |

1negative values result from settlement of prior-year contracts

Total sales revenue of KGHM Polska Miedź S.A. in 2018 amounted to PLN 15 757 million and was comparable to the revenues achieved in 2017 (a decrease by 2%, in 2017: PLN 16 024 million).

Revenues from copper sales in 2018 amounted to PLN 12 342 million, or a difference of +1% compared to the level of sales revenue in the prior year (PLN 12 213 million).

Revenues from metallic silver sales in 2018 amounted to PLN 2 101 million and were lower by 14% as compared to the level of sales revenue in 2017. Additionally, in 2018 KGHM Polska Miedź S.A. earned revenues from the sale of silver in concentrate in the amount of PLN 141 million.

The decrease in revenues from silver sales in 2018 was mainly due to the decrease in the price of this metal expressed in the Polish zloty as compared to 2017. Revenues from gold sales in 2018 amounted to PLN 381 million, and in 2017 to PLN 556 million. The difference was due to lower production of gold in 2018.

Sales revenue of KGHM Polska Miedź S.A. (PLN million)

| 2017 | 2018 | Change (%) | 4Q'18 | 3Q'18 | 2Q'18 | 1Q'18 | |

|---|---|---|---|---|---|---|---|

| Cathodes and cathode parts | 5 541 | 5 097 | (8.0) | 1 725 | 1 345 | 1 191 | 836 |

| Copper wire rod and OFE rod | 6 276 | 6 525 | +4.0 | 1 630 | 1 623 | 1 662 | 1 610 |

| Payable copper in concentrate1 | 86 | 400 | ×4.7 | 73 | 99 | 228 | - |

| Other copper products | 310 | 320 | +3.2 | 74 | 82 | 85 | 79 |

| Total copper and copper products | 12 213 | 12 342 | +1.1 | 3 502 | 3 149 | 3 166 | 2 525 |

| Metallic silver | 2 447 | 2 101 | (14.1) | 607 | 628 | 474 | 392 |

| Payable silver in concentrate2 | -6 | 141 | × | 22 | 55 | 64 | - |

| Metallic gold | 556 | 381 | (31.5) | 101 | 100 | 89 | 91 |

| Refined lead | 273 | 262 | (4.0) | 68 | 66 | 60 | 68 |

| Other goods and services | 356 | 345 | (3.1) | 93 | 87 | 78 | 87 |

| Merchandise and materials | 185 | 185 | - | 47 | 43 | 52 | 43 |

| Total sales revenue | 16 024 | 15 757 | (1.7) | 4 440 | 4 128 | 3 983 | 3 206 |

1 value of payable copper less treatment charges (TC), Cu refining charges (RcCu) and other deductions impacting the value of Cu concentrate (apart from the Ag refining premium)

2 value of payable silver less the Ag refining premium (RcAg), negative values result from settlement of prior-year contracts

Geographical breakdown of sales

The largest proportion, i.e. 26%, of KGHM Polska Miedź S.A.’s sales revenue in 2018 was from the Polish market. The largest remaining recipients of the products, merchandise and services offered by the Company were: China, Germany, the United Kingdom and Czechia.

The Company’s revenues from sales to external customers is broken down geographically in the following table. Sales revenue includes the result from the settlement of hedging instruments.

Sales revenue of KGHM Polska Miedź S.A. by market (PLN million)

Operations and results in 2018

Costs

The Company’s cost of sales, selling costs and administrative expenses (cost of products, merchandise and materials sold plus selling costs and administrative expenses) in 2018 amounted to PLN 13 460 million and was 4% higher as compared to 2017. The Company’s cost of sales, selling costs and administrative expenses was substantially affected by the change in inventories of half-finished products, products and work in progress, which in 2018 amounted to -PLN 236 million (in 2017 - PLN 1 097 million) and was mainly due to the decrease in the level of half-finished products inventories. At the end of 2018 there was a slight increase in inventories of work in progress and finished goods.

Total expenses by nature in 2018 as compared to 2017 were lower by 2.1%, mainly due to the lower consumption of purchased metal-bearing materials (a lower amount by 27 thousand tonnes and a lower price by 1.5%) as well as a lower minerals extraction tax (lower production of own concentrate and lower silver prices).

Expenses by nature of KGHM Polska Miedź S.A. (PLN million)

| 2017 | 2018 | Change (%) | 4Q’18 | 3Q’18 | 2Q’18 | 1Q’18 | |

|---|---|---|---|---|---|---|---|

| Depreciation of property, plant and equipment and amortisation of intangible assets | 1 072 | 1 173 | +9.4 | 305 | 288 | 287 | 293 |

| Employee benefits expenses | 3 210 | 3 324 | +3.6 | 805 | 835 | 902 | 782 |

| Materials and energy, including: | 5 831 | 5 312 | (8.9) | 1 471 | 1 292 | 1 144 | 1 405 |

| 3 750 | 3 040 | (18.9) | 862 | 701 | 611 | 866 |

| 775 | 803 | +3.6 | 203 | 228 | 187 | 185 |

| External services | 1 531 | 1 649 | +7.7 | 455 | 406 | 419 | 369 |

| Taxes and charges, including: | 2 154 | 2 083 | (3.3) | 471 | 494 | 575 | 543 |

| 1 765 | 1 671 | (5.3) | 374 | 397 | 466 | 434 |

| Other costs | 126 | 92 | (27.0) | 26 | 22 | 15 | 29 |

| Total expenses by nature | 13 924 | 13 633 | (2.1) | 3 533 | 3 337 | 3 342 | 3 421 |

Structure of expenses by nature in 2018

The structure of expenses by nature in 2018 is presented below. As compared to the prior year, they were at a very similar level. The Company’s operating costs are decisively impacted by the costs of electrolytic copper production (prior to decrease by the value of by-products), whose share is about 91%.

Cost of producing copper in concentrate - C1 (unit cash cost of producing payable copper in concentrate, reflecting costs of ore extraction and processing, transport costs, the minerals extraction tax, administrative costs during the mining stage, and smelter treatment and refining charges (TC/RC), less the value of by-products) was as follows: in 2017: 1.52 USD/lb and in 2018: 1.85 USD/lb. The cost was impacted by a strengthening in the PLN as compared to the USD, lower silver prices and lower production of own concentrate.

Cost of producing copper in concentrate – C1 (USD/lb)

* including tax on the extraction of certain minerals

The pre-precious metals credit unit cost of copper production from own concentrate (unit cost prior to decrease by the value of anode slimes containing among others silver and gold) was higher than that recorded in 2017 by 1 275 PLN/t (6%), alongside a lower minerals extraction tax (-56 PLN/t) and higher production from own concentrate by 26 thousand tonnes of Cu (7.3%). The increase in the unit cost was mainly due to higher costs of materials, fuel and energy (excluding purchased metal-bearing materials), labour costs, depreciation/amortisation and external services.

Pre-precious metals credit unit cost of electrolytic copper production – from own concentrate (PLN/t)

1 value of anode slurries

2 total unit cost of copper production from own charges

Operations and results in 2018

Financial results

Statement of profit or loss

The Company recorded a profit for 2018 in the amount of PLN 2 025 million, or PLN 702 million (53%) higher than in the prior year.

Basic items of the statement of profit or loss of KGHM Polska Miedź S.A. (PLN million)

| 2017 | 2018 | Change (%) | 4Q'18 | 3Q'18 | 2Q'18 | 1Q'18 | |

|---|---|---|---|---|---|---|---|

| Sales revenue | 16 024 | 15 757 | (1.7) | 4 440 | 4 128 | 3 983 | 3 206 |

| 16 | 125 | ×7.8 | 15 | 34 | 18 | 57 |

| Cost of sales, selling costs and administrative expenses | (12 899) | (13 460) | +4.3 | (3 911) | (3 526) | (3 337) | (2 686) |

| (1 488) | (1 705) | +14.6 | (477) | (427) | (447) | (354) |

| Profit on sales (EBIT) | 3 125 | 2 297 | (26.5) | 529 | 602 | 646 | 520 |

| Other operating income / (costs) | (2 004) | 1 149 | × | 490 | (49) | 625 | 83 |

| (1 179) | 386 | × | 162 | (103) | 451 | (124) |

| 310 | 244 | (21.3) | 56 | 62 | 69 | 57 |

| 4 | 239 | ×59.8 | - | - | 239 | - |

| (23) | (162) | ×7.0 | (10) | (3) | (148) | (1) |

| (213) | (136) | (36.2) | (49) | (59) | (6) | (22) |

| 51 | 53 | +3.9 | 4 | 21 | 10 | 18 |

| (330) | 355 | × | 355 | - | - | - |

| N/A1 | (63) | × | (115) | 11 | (72) | 113 |

| N/A1 | 183 | × | (6) | 18 | 136 | 35 |

| N/A1 | (4) | × | 40 | - | (42) | (2) |

| N/A1 | 85 | × | 85 | - | - | - |

| N/A1 | 15 | × | - | - | - | 15 |

| (606) | N/A1 | × | N/A1 | N/A1 | N/A1 | N/A1 |

| (18) | (46) | ×2.6 | (32) | 4 | (12) | (6) |

| Finance income / (costs) | 1 033 | (774) | × | (275) | 97 | (720) | 124 |

| 1 247 | (592) | × | (206) | 145 | (681) | 150 |

| (113) | (127) | +12.4 | (37) | (32) | (34) | (24) |

| (28) | (23) | (17.9) | (5) | (6) | (6) | (6) |

| (30) | 11 | × | (17) | 2 | 11 | 15 |

| (43) | (43) | - | (10) | (12) | (10) | (11) |

| Profit / (loss) before income tax | 2 154 | 2 672 | +24.0 | 744 | 650 | 551 | 727 |

| Income tax expense | (831) | (647) | (22.1) | (149) | (207) | (94) | (197) |

| PROFIT / (LOSS) FOR THE PERIOD | 1 323 | 2 025 | +53.1 | 595 | 443 | 457 | 530 |

| Depreciation/amortisation recognised in profit or loss | 1 035 | 1 119 | +8.1 | 299 | 286 | 283 | 251 |

| EBITDA2 (EBIT + depreciation/amortisation) | 4 160 | 3 416 | (17.9) | 828 | 888 | 929 | 771 |

| Adjusted EBITDA3 | 4 160 | 3 416 | (17.9) | 828 | 888 | 929 | 771 |

1„N/A” – not applicable – items which were not measured in accordance with principles arising from the application, from 1 January 2018, of IFRS 9.

2 EBITDA = EBIT + depreciation/amortisation (recognised in profit or loss)

3 Adjusted EBITDA = EBIT + depreciation/amortisation (recognised in profit or loss) + impairment loss (-reversal of impairment losses) on non-current assets, recognised in cost of sales, selling costs and administrative expenses

Main reasons for the change in profit/(loss) of KGHM Polska Miedź S.A.

Below are the main values that have an impact on changing the result of the comparison between 2017 and 2018:

| Item | Impact on change in result (PLN million) | Description |

|---|---|---|

| Decrease in sales revenue by PLN 376 million (excluding the impact of hedging transactions +PLN 109 million) | (643) | A decrease in revenues from sales of basic products (Cu, Ag, Au) due to a less favourable average annual USD/PLN exchange rate (a change from 3.78 to 3.61 USD/PLN). |

| (575) | A decrease in revenues due to a lower volume of copper sales (-14.2 kt, -3%), silver (-38 t, -3%) and gold (-33 koz t, -28%). | |

| +461 | An increase in revenues due to the sale of copper concentrate from PLN 80 million to PLN 541 million. | |

| +419 | An increase in revenues due to higher prices of copper (+357 USD/t, +6%) and gold (+11 USD/koz t, +1%) alongside lower silver prices (‑134 USc/koz t, -8%). | |

| (38) | A decrease in revenues due to the sale of merchandise and other goods and services, including the value of third party processing of concentrate into cathodes (-PLN 58 million) and lower sales of refined lead (-PLN 12 million). | |

| An increase in cost of sales, selling costs and administrative expenses1 by PLN 561 million | (861) | A change in inventories of half-finished products, products and work in progress in 2018 (reducing costs) amounting to -PLN 236 million, compared to 2017: -PLN 1 097 million. |

| +710 | Lower consumption of purchased metal-bearing materials by 27 thousand tonnes Cu (-18%) alongside a lower purchase price by 1.5%. | |

| (410) | Including an increase in other expenses by nature by PLN 419 million, mainly due to a change in costs: other materials and energy (+PLN 191 million), external services (+PLN 118 million), depreciation/amortisation (+PLN 101 million), employee benefits (+PLN 114 million) and the minerals extraction tax (-PLN 94 million). | |

| Impairment losses recognised/reversed on shares and investment certificates in subsidiaries | +685 | Change in the balance of impairment losses recognised/ reversed from -PLN 330 million in 2017 to PLN +355 million in 2018 |

| Impact of exchange differences (‑PLN 274 million) | +1 565 | A change in the result due to exchange differences from measurement of assets and liabilities other than borrowings – in other operating activities. |

| (1 839) | A change in the result due to exchange differences on measurement of borrowings (presented in finance costs). | |

| Dividend income | +235 | An increase in dividend income from PLN 4 million to PLN 239 million. |

| Impact of hedging transactions (+PLN 227 million) | +109 | A change in adjustments to sales revenue due to the settlement of hedging transactions from PLN 16 million to PLN 125 million. |

| +248 | A change in the result due to the measurement of derivatives from -PLN 233 million to +PLN 15 million. | |

| (130) | A change in the result due to the realisation of derivatives from -PLN 10 million to -PLN 140 million. | |

| Provisions recognised | (139) | Provisions recognised in 2018 in the amount of PLN 162 million versus PLN 23 million in the prior year. The provisions recognised in 2018 were mainly in respect of disputed issues (PLN 103 million) mainly involving rationalisation and inventions and the property tax on mining divisions (PLN 49 million). |

| Change in the balance of income and costs due to interest on borrowings, including fees and commissions (-PLN 75 million) | (66) | A decrease in income due to interest on loans granted. |

| (14) | Higher interest costs on borrowings. | |

| +5 | A decrease in costs of fees and commissions on bank loans drawn. | |

| Items which were not measured under the principles applied in accordance with IFRS 9 since 1 January 2018 (+PLN 822 million) | (63) | Fair value gains/(losses) on financial assets measured at fair value through profit or loss (in 2018) |

| +183 | Reversal of allowances for impairment of loans measured at amortised cost (in 2018) | |

| (4) | Allowances for impairment of loans under IFRS 9 (in 2018) | |

| +85 | Reversal of impairment losses on assets impaired at the moment of initial recognition | |

| +15 | (Recognition)/reversal of allowances for impairment of loans due to restructuring of intra-group financing (in 2018) | |

| +606 | Allowances for impairment of loans under IAS 39 (in 2017) | |

| Income tax reduction | +184 | The lower tax results from the lower tax base. |

1 Cost of products, merchandise and materials sold plus selling costs and administrative expenses

Change in profit for the period of KGHM Polska Miedź S.A. (PLN million)

1Excluding adjustment for hedging transactions

Cash flows

Statement of cash flows of KGHM Polska Miedź S.A. (PLN million)

| 2017 | 2018 | Change (%) | 4Q'18 | 3Q'18 | 2Q'18 | 1Q'18 | |

|---|---|---|---|---|---|---|---|

| Profit / (loss) before income tax | 2 154 | 2 672 | +24.0 | 744 | 650 | 551 | 727 |

| 1 035 | 1 119 | +8.1 | 299 | 286 | 283 | 251 |

| (299) | (219) | (26.8) | (43) | (57) | (65) | (54) |

| 940 | (623) | × | (465) | (19) | (91) | (48) |

| 304 | 23 | (92.4) | 275 | (111) | 88 | (229) |

| Exclusions of income and costs, total | 1 980 | 300 | (84.8) | 66 | 99 | 215 | (80) |

| Income tax paid | (934) | (710) | (24.0) | (189) | (189) | (188) | (144) |

| Changes in working capital | (1 120) | 553 | × | 1 059 | 207 | (128) | (585) |

| Net cash generated from operating activities | 2 080 | 2 815 | +35.3 | 1 680 | 767 | 450 | (82) |

| Expenditures on mining and metallurgical assets | (1 970) | (1 884) | (4.4) | (523) | (419) | (386) | (556) |

| Expenditures on other property, plant and equipment and intangible assets | (21) | (23) | +9.5 | 3 | (7) | (4) | (15) |

| Loans granted | (490) | (682) | +39.2 | (413) | - | (264) | (5) |

| Other expenses | (83) | (84) | +1.2 | (17) | (14) | (15) | (38) |

| Dividends received | 4 | 239 | ×59.8 | - | 138 | 101 | - |

| Other proceeds | 48 | 35 | (27.1) | 7 | 3 | 19 | 6 |

| Net cash used in investing activities | (2 512) | (2 399) | (4.5) | (943) | (299) | (549) | (608) |

| Proceeds from borrowings | 2 416 | 2 257 | (6.6) | 221 | (8) | 932 | 1 112 |

| Repayments of borrowings | (2 030) | (2 073) | +2.1 | (692) | (235) | (665) | (481) |

| Proceeds from cash pooling | 160 | - | × | - | - | (60) | 60 |

| Expenses due to cash pooling | - | (80) | × | (30) | (10) | (40) | - |

| Dividends paid | (200) | - | × | - | - | - | - |

| Interest paid and other costs of borrowings | (138) | (152) | +10.1 | (45) | (41) | (36) | (30) |

| Net cash generated from/(used in) financing activities | 208 | (48) | × | (546) | (294) | 131 | 661 |

| TOTAL NET CASH FLOW | (224) | 368 | × | 191 | 174 | 32 | (29) |

| Foreign exchange gains/(losses) on cash and cash equivalents | (24) | 25 | × | 7 | 6 | 2 | 10 |

| Cash and cash equivalents at the beginning of the period | 482 | 234 | (51.5) | 429 | 249 | 215 | 234 |

| Cash and cash equivalents at the end of the period | 234 | 627 | ×2.7 | 627 | 429 | 249 | 215 |

Net cash generated from operating activities in 2018 amounted to +PLN 2 815 million and mainly comprised profit before income tax in the amount of PLN 2 672 million adjusted by depreciation/amortisation in the amount of +PLN 1 119 million, less income tax paid in the amount of -PLN 710 million and the change in working capital in the amount of +PLN 553 million.

Net cash used in investing activities in 2018 amounted to -PLN 2 399 million and mainly comprised net expenditures on mining and metallurgical property, plant and equipment and intangible assets in the amount of ‑PLN 1 884 million and loans granted of -PLN 682 million alongside dividend income in the amount of PLN 239 million.

Net cash used in financing activities during the same period amounted to -PLN 48 million and mainly comprised proceeds from borrowings in the amount of +PLN 2 257 million as well as repayments of borrowings and the cash pooling in the amounts respectively of: ‑PLN 2 073 million and -PLN 80 million, along with interest paid and other costs of borrowings in the amount of ‑PLN 152 million.

After reflecting exchange gains/losses on cash and cash equivalents, at the end of 2018 cash and cash equivalents increased by PLN 393 million and amounted to PLN 627 million.

Cash flows of KGHM Polska Miedź S.A. (PLN million)

Assets, equity and liabilities

Assets of KGHM Polska Miedź S.A. (PLN million)

| 31.12.2018 | 31.12.2017 | Change (%) | 30.09.2018 | 30.06.2018 | 31.03.2018 | |

|---|---|---|---|---|---|---|

| Mining and metallurgical property, plant and equipment | 16 382 | 15 355 | +6.7 | 15 674 | 15 554 | 15 373 |

| Mining and metallurgical intangible assets | 576 | 507 | +13.6 | 557 | 550 | 532 |

| Other property, plant and equipment | 92 | 75 | +22.7 | 71 | 69 | 71 |

| Other intangible assets | 52 | 34 | +52.9 | 34 | 34 | 32 |

| Investments in subsidiaries | 3 510 | 3 013 | +16.5 | 3 020 | 3 013 | 3 013 |

| Financial instruments, including: | 7 453 | 6 031 | +23.6 | 6 742 | 6 781 | 5 901 |

| 6 262 | 4 972 | +25.9 | 5 559 | 5 580 | 4 780 |

| 319 | 109 | ×2.9 | 398 | 328 | 212 |

| 496 | 613 | (19.1) | 419 | 508 | 534 |

| 376 | 337 | +11.6 | 366 | 365 | 375 |

| Deferred tax assets | 9 | 31 | (71.0) | 94 | 140 | 110 |

| Other non-financial assets | 24 | 25 | (4.0) | 35 | 22 | 24 |

| Non-current assets | 28 098 | 25 071 | +12.1 | 26 227 | 26 163 | 25 056 |

| Inventories | 4 102 | 3 857 | +6.4 | 4 588 | 4 627 | 4 651 |

| Trade receivables | 310 | 1 034 | (70.0) | 782 | 683 | 730 |

| Tax assets | 275 | 214 | +28.5 | 167 | 166 | 160 |

| Derivatives | 300 | 195 | +53.8 | 243 | 158 | 263 |

| Other assets | 538 | 342 | +57.3 | 569 | 693 | 405 |

| Cash and cash equivalents | 627 | 234 | ×2.7 | 429 | 249 | 215 |

| Current assets | 6 152 | 5 876 | +4.7 | 6 778 | 6 576 | 6 424 |

| TOTAL ASSETS | 34 250 | 30 947 | +10.7 | 33 005 | 32 739 | 31 480 |

As at 31 December 2018, total assets amounted to PLN 34 250 million, or an increase as compared to the end of 2017 by PLN 3 303 million, or by 11%, mainly due to increases in the following items:

- non-current financial instruments by PLN 1 422 million, including mainly loans granted (+PLN 1 290 million) and derivatives (+PLN 210 million),

- mining and metallurgical property, plant and equipment by PLN 1 027 million, arising from the realisation of investments – expenditures on property, plant and equipment and intangible assets in 2018 amounted to

PLN 2 132 million, - cash and cash equivalents by PLN 393 million and

- inventories by PLN 245 million, including mainly half-finished products and work in progress (+PLN 144 million) and finished products (+PLN 117 million).

alongside a decrease in trade receivables by PLN 724 million, in connection with the implementation of new receivables financing programs (factoring), a decrease of copper prices in the second half of 2018 and a change in the manner of settling December spot contracts.

Change in assets of KGHM Polska Miedź S.A. in 2018 (PLN million)

The carrying amounts of equity and liabilities as at 31 December 2018 are presented below.

Equity and liabilities of KGHM Polska Miedź S.A. (PLN million)

| 31.12.2018 | 31.12.2017 | Change (%) | 30.09.2018 | 30.06.2018 | 31.03.2018 | |

|---|---|---|---|---|---|---|

| Share capital | 2 000 | 2 000 | - | 2 000 | 2 000 | 2 000 |

| Other reserves from measurement of financial instruments | (307) | 142 | × | (419) | (518) | (439) |

| Accumulated other comprehensive income | (593) | (348) | +70.4 | (499) | (537) | (495) |

| Retained earnings | 17 945 | 15 462 | +16.1 | 17 263 | 16 820 | 16 363 |

| Equity | 19 045 | 17 256 | +10.4 | 18 345 | 17 765 | 17 429 |

| 6 758 | 6 085 | +11.1 | 7 012 | 7 343 | 5 863 |

| 68 | 84 | (19.0) | 82 | 97 | 80 |

| 2 235 | 1 879 | +18.9 | 2 125 | 2 139 | 2 049 |

| 980 | 797 | +23.0 | 791 | 844 | 794 |

| 199 | 207 | (3.9) | 202 | 196 | 211 |

| Non-current liabilities | 10 240 | 9 052 | +13.1 | 10 212 | 10 619 | 8 997 |

| 1 035 | 923 | +12.1 | 1 053 | 1 112 | 1 627 |

| 80 | 160 | (50.0) | 110 | 120 | 220 |

| 13 | 74 | (82.4) | 11 | 16 | 36 |

| 1 920 | 1 719 | +11.7 | 1 452 | 1 145 | 1 321 |

| 611 | 649 | (5.9) | 709 | 614 | 759 |

| 405 | 416 | (2.6) | 377 | 593 | 428 |

| 901 | 698 | +29.1 | 736 | 755 | 663 |

| Current liabilities | 4 965 | 4 639 | +7.0 | 4 448 | 4 355 | 5 054 |

| Non-current and current liabilities | 15 205 | 13 691 | +11.1 | 14 660 | 14 974 | 14 051 |

| TOTAL EQUITY AND LIABILITIES | 34 250 | 30 947 | +10.7 | 33 005 | 32 739 | 31 480 |

There was an increase in equity and liabilities, mainly due to increases in the following items:

- equity by PLN 1 789 million, including with respect to the profit for 2018 in the amount of PLN 2 025 million,

- borrowings and cash pool liabilities by PLN 705 million, due to exchange rate differences (+PLN 597 million), accrued interest (+PLN 277 million) and cash flows (-PLN 169 million),

- employee benefits liabilities by PLN 318 million and in trade payables by PLN 200 million, and

- provisions for decommissioning costs of mines and other technological facilities by PLN 184 million,

alongside a decrease in derivatives by PLN 77 million.

Change in equity and liabilities of KGHM Polska Miedź S.A. in 2018 (PLN million)

Contingent assets and liabilities

At the end of 2018, contingent assets amounted to PLN 558 million and related mainly to promissory notes receivables (PLN 225 million) and guarantees received by the Company with respect to the proper performance of agreements (PLN 168 million).

At the end of 2018, contingent liabilities amounted to PLN 3 151 million and mainly concerned guarantees and letters of credit in the total amount of PLN 2 828 million and due to promissory notes payable in the amount of PLN 176 million, including:

- a corporate guarantee securing repayment of a specified part of payment to guarantees set by Sumitomo Metal Mining Co., Ltd. and Sumitomo Corporation, securing repayment of a corporate loan drawn by the joint venture Sierra Gorda S.C.M. (PLN 677 million),

- a letter of credit granted set as security for the proper performance of a long-term contract for the off-take of electricity to the joint venture Sierra Gorda S.C.M. (PLN 517 million),

- corporate guarantees securing the repayment of short term working capital facilities drawn by the joint venture Sierra Gorda S.C.M. (PLN 496 million),

- a security for the costs of restoring the areas of the Robinson mine, Podolsky mine and the Victoria project, and obligations related to the proper performance of the agreements signed (PLN 401 million),

- a security for the proper performance of future environmental obligations of the Company to restore the area, following the conclusion of operations of the Żelazny Most tailings storage facility (PLN 160 million in the form of a bank guarantee and PLN 160 million in the form of an own promissory note),

- a security for the proper performance by DMC Mining Services (UK) Ltd. and DMC Mining Services Ltd. of a contract for sinking shafts under a project underway in the United Kingdom (PLN 188 million),

- corporate guarantees securing the proper performance of lease agreements entered into by the joint venture Sierra Gorda S.C.M. (PLN 125 million).

Other liabilities not recognised in the statement of financial position in the amount of PLN 451 million, comprised of:

- liabilities due to an operating lease in the amount of PLN 338 million,

- liabilities towards local government entities due to expansion of the tailings storage facility by KGHM Polska Miedź S.A. in the amount of PLN 113 million.

Capital expenditures

In 2018, capital expenditures on property, plant and equipment amounted to PLN 2 127 million and were higher than in the previous year by 4%. Together with expenditures incurred on uncompleted development work, capital expenditures amounted to PLN 2 132 million.

Structure of expenditures on property, plant and equipment and intangible assets of KGHM Polska Miedź S.A. (PLN million)

| 2017 | 2018 | Change (%) | 4Q'18 | 3Q'18 | 2Q'18 | 1Q'18 | |

|---|---|---|---|---|---|---|---|

| Mining | 1 286 | 1 483 | +15.3 | 580 | 352 | 300 | 251 |

| Metallurgy | 735 | 573 | (22.0) | 261 | 116 | 118 | 78 |

| Other activities | 32 | 71 | ×2.2 | 55 | 9 | 6 | 1 |

| Development work - uncompleted | 4 | 5 | +25.0 | 4 | 1 | - | - |

| Total | 2 057 | 2 132 | +3.6 | 900 | 478 | 424 | 330 |

| including borrowing cost | 61 | 133 | ×2.2 | 33 | 33 | 42 | 25 |

Investment activities comprised projects related to the replacement of equipment and maintaining mine production, as well as development projects:

Projects related to the replacement of equipment aimed at maintaining production equipment in an undeteriorated condition, represent 36% of total expenditures incurred.

Projects related to maintaining mine production aimed at maintaining mine production on the level set in approved Production Plan (development of infrastructure to match mine advancement) represent 26% of total expenditures incurred.

Development projects aimed at increasing production volume of the core business, implementation of technical and technological activities optimising use of existing infrastructure, maintaining production costs and adaptation of the company’s operations to changes in standards, laws and regulations (conformatory projects and those related to environmental protection) represent 38% of total expenditures incurred.

Major tasks and facilities advanced by KGHM Polska Miedź S.A. in 2018

| Replacement (PLN 768 million) | |

|---|---|

| Mining machinery replacement | With respect to modernisation and replacement of mining machinery, 263 mining machines were purchased. Expenditures incurred in 2018: PLN 266 million. |

| Infrastructure replacement - other | Investments aimed at the replacement of infrastructure in the Divisions in order to maintain it in an undeteriorated condition. Expenditures incurred in 2018: PLN 502 million. |

| Mining Development (PLN 508 million) | |

|---|---|

| Deposit Access Program | Work continues under the Program on sinking of the GG-1 ventilation and material-transport shaft with a target depth of 1 350 meters with a diameter of 7.5 meters. The shaft’s depth has reached 1 070 meters (as at 31 December 2018). In 2018, construction began on the Surface-based Central Air Conditioning System (PSK) at the GG-1 shaft. A decision was received with respect to environmental conditions to advance the PSK as well as a building permit. With respect to the project to build an Ice Water Transportation System (IWTS), in 2018 work continued related to advancing the construction project and on obtaining an environmental decision to advance the IWTS. In 2018 an agreement was signed with the Gmina (municipality) of Żukowice and procedures commenced related to amending planning documentation with respect to the planned construction of the GG-2 „Odra” shaft. In 2018, 45 kilometers of tunneling were excavated in the Rudna and Polkowice-Sieroszowice mines, representing nearly 80% of the total amount of access and development tunnels in KGHM. As at 31 December 2018, total expenditures incurred on the Deposit Access Program amounted to PLN 3 010 million, including PLN 413 million in 2018 (development expenditures alone amounted to PLN 365 million). |

| Change in the L-VI shaft’s function to a material–transport shaft | In 2018, the complete power supply system for the L-VI shaft region was brought online. Final work is underway on: construction of the shaft complex together with buildings and surface infrastructure; construction of the rainwater pipeline and of the sewage pipeline together with telecommunications cables between shafts L-VI and L-I. In addition, in 2018 construction commenced on the following buildings: for the shipment of explosives, the Góra Logistics Center, a waste processing building and the construction of functional chambers together with the Underground Logistics Center. Work is underway on a mine telecommunications-announcements system: SAT-DOTRA. As at 31 December 2018, expenditures were incurred in the amount of PLN 235 million, including PLN 120 million in 2018. |

| Modernisation of classification systems in the Concentrators Division | Polkowice Concentrator: work was completed on two more hydrocyclone batteries. A contractor was selected for the construction of the last 9 classification units. Lubin Concentrator: work was completed on 8 classification units and they were brought online. Rudna Concentrator: work was completed on 4 classification units. As at 31 December 2018, expenditures were incurred in the amount of PLN 126 million, including PLN 30 million in 2018. |

| Metallurgy Development (PLN 241 million) | |

|---|---|

| Program to adapt the technological installations of KGHM to the requirements of BAT Conclusions for the non-ferrous metals industry together with restricting arsenic emissions (BATAs) | The BATAs Program which began in 2018 comprises 26 new investment projects, including 20 at the Głogów Copper Smelter and Refinery and 6 at the Legnica Copper Smelter and Refinery. By the end of December 2018 11 projects had commenced, including 9 at the Głogów Copper Smelter and Refinery and 2 at the Legnica Copper Smelter and Refinery. In addition, 7 tenders are underway, while project assumptions are being updated for 8 projects. A decision was made to terminate 2 of the projects underway at the Głogów Copper Smelter and Refinery. As at 31 December 2018, expenditures were incurred in the amount of PLN 2 million. |

| Metallurgy Development Program | In 2018 the stage of technological trials for the steam drier was completed. Following the maintenance shutdown of the Głogów II Copper Smelter and Refinery, production is underway with the full use of the newly-built steam drier. Work is underway on the settlements and final handover stage. The concentrate roasting installation is undergoing start-up trials. In terms of conformatory projects work continues on settlements with contractors, the completion of post-construction documentation and obtaining operating permits. As at 31 December 2018, expenditures on the program were incurred in the amount of PLN 1 192 million, including PLN 52 million in 2018. |

| Increasing cathode production at the Legnica Copper Smelter and Refinery to 160 kt of copper cathode/year (HML160) | In 2018 work on the project comprised continued construction of the Revolving-Casting-Refining Furnace (RCR) at the Legnica Copper Smelter and Refinery. The following equipment was assembled: the RCR furnace, post combustion chamber, full evaporation tower, casting machinery, the installation to provide utilities, electrical installation and the APKiA (“Aparatury Kontrolno-Pomiarowej i Automatyki”, or Control-Measurement and Automation Apparatus). As at 31 December 2018, expenditures were incurred in the amount of PLN 96 million, including PLN 83 million in 2018. |

| Pyrometallurgy Modernisation Program (PMP) | Production by the flash furnace of the Głogów I Copper Smelter and Refinery was stabilised in accordance with the current production plan. Settlement procedures and the final handovers of contracts and orders with respect to the Pyrometallurgy Modernisation Program are near completion. |

| Other Development (PLN 43 million) | |

|---|---|

| KGHM 4.0 Program | The KGHM 4.0 Program which began in 2018 is a venture which addresses the Industry 4.0. concept within the technical-organisational environment of KGHM Polska Miedź S.A. The KGHM 4.0 Program comprises the advancement of projects in 3 areas: INDUSTRY, ICT and SUPPORTING PROJECTS. The Program is aimed at the unified management of production and the utilisation of data in order to improve productivity and efficiency. In December 2018 an electric vehicle charging station open to the public was created in Lubin. This is a result of an agreement with the company Tauron, which foresees the cooperation between the companies in the area of electromobility, including the construction of vehicle charging station infrastructure for car-sharing services (so-called “auta na minuty”), and mutual pro-ecological activities. As at 31 December 2018, expenditures were incurred in the amount of PLN 41 million. |

| Exploration Development (PLN 12 million) | |

|---|---|

| Exploration projects | Synklina Grodziecka, Konrad – Synklina Grodziecka, Konrad – hydrogeological research planned for the years 2018-2020 remains underway. In January 2019 administrative proceedings in the concession-granting body for the Synklina Grodziecka concession were concluded. Retków-Ścinawa – Based on the results from 3 drillholes sunk in 2017 (S‑761, S-708 and S-745) it was decided to alter the scope of drilling under the concessions a result of which in December 2017 it became necessary to introduce changes in the scope of planned geological and mining work by submitting a request to the Ministry of the Environment for a change in the concession. In the third quarter of 2018 a decision was received altering the concession and work commenced on the sinking of another drillhole under stage 2 of the geological research. Głogów - In 2018, surface-based geophysical research was conducted under stage 2 of the geological research. At the start of December 2018 a request was submitted to the concession-granting body for a change in the concession involving extension of its life (to March 2020). Bytom Odrzański, Kulów–Luboszyce – On 30 November 2017 the Supreme Administrative Court dismissed the claims of KGHM against a decision of the Regional Administrative Court dated 10 July 2015. At the start of 2019 the Ministry of the Environment announced a re-opening of the proceedings regarding a re-hearing of concession applications. Puck region - in 2018 drilling work continued and Amendment no. 1 to the Geological Work Project, in which a proposal was made for an additional drillhole, was submitted to the concession-granting body for its approval. At a hearing on 27 February 2019, the Supreme Administrative Court dismissed the cassation appeals of a competing company which had filed a complaint against the concession granted to KGHM for the same region. In the years 2010-2018 expenditures were incurred on exploration projects in the amount of PLN 363 million, including PLN 12 million in 2018. |

Non-financial results in 2018

GRI indicators of ethical behavior

G205-3 – Confirmed corruption cases and actions taken in response thereto in 2018

| Recorded corruption cases ended in: | KGHM Polska Miedź S.A. Group | KGHM Polska Miedź S.A. |

|---|---|---|

| disciplinary dismissal or punishment of employees | 1 | 0 |

| refusal to renew contracts with business partners due to breach of corruption rules | 0 | 0 |

| legal actions pertaining to corruption practices taken against the reporting organization or its employees in the reporting period | 0 | 0 |

| Total | 1 | 0 |

GRI indicators of ethical behaviour

Selected GRI HR indicators

Total number of employees

| Total number of employees (head count) | Number of employees | |

|---|---|---|

| KGHM Group | KGHM Polska Miedź S.A. | |

| Total | 34,386 | 18,331 |

Number of new hires and employee departures

New hires in 2018:

| Total number of employees (head count) broken down to: | Number of employees (head count) | Number of new hires | Percentage of new hires (head count) | |||

|---|---|---|---|---|---|---|

| KGHM Group | KGHM Polska Miedź S.A. | GK KGHM | KGHM Polska Miedź S.A. | KGHM Group | KGHM Polska Miedź S.A. | |

| Total | 34,249 | 18,500 | 2,723 | 1,135 | 7.95 % | 6.14 % |

Employee departures in 2018:

| Total number of employee departures (head count) broken down to: | Number of employees (head count) | Number of employee departures (head count) | Percentage of employee departures | |||

|---|---|---|---|---|---|---|

| KGHM Group | KGHM Polska Miedź S.A. | KGHM Group | KGHM Polska Miedź S.A. | KGHM Group | KGHM Polska Miedź S.A. | |

| Total | 34,249 | 18,500 | 2,254 | 988 | 6.58 % | 5.34 % |

Number of work-related accidents by gender

| KGHM Group | KGHM Polska Miedź S.A. | |||

|---|---|---|---|---|

| Women | Men | Women | Men | |

| Total number of work accidents (incidents) | 115 | 558 | 2 | 295 |

| Number of fatal accidents (incidents) | 0 | 3 | 0 | 2 |

| Number of severe accidents (incidents) | 3 | 20 | 0 | 2 |

| Number of minor accidents (incidents) | 106 | 537 | 0 | 293 |

| Total number of people injured in accidents | 673 | 291 | ||

Average number of hours of training during the year per employee

| Total number of training hours | ||

|---|---|---|

| TOTAL | ||

| KGHM Group | KGHM Polska Miedź S.A. | |

| Total number of training hours | 662,066.50 | 501,352.00 |

| Number of employees | 34,249 | 18,500 |

| Average number of training hours | 19.33 | 27.10 |

Selected GRI standards performance indicators reflecting activities relating to social issues

Selected GRI Standards indicators for 2018 presenting actions in the area of social issues:

List of donations from the KGHM Polska Miedź Foundation for institutions in 2018, by areas

| No. | Areas | Donations | |

|---|---|---|---|

| Amount awarded (gross) PLN | Number of projects | ||

| 1. | Health and Safety | 3,686,410.00 | 74 |

| 2. | Science and education | 2,515,532.33 | 73 |

| 3. | Sports and recreation | 4,041,192.10 | 166 |

| 4. | Culture and tradition | 8,263,551.65 | 150 |

| Total | 18,506,686.08 | 463 | |

List of donations from the KGHM Polska Miedź Foundation for individuals in 2018, by areas

| Purpose of the donation | Donations | Number of donations | Location of donations | |||

|---|---|---|---|---|---|---|

| Amount awarded (gross, PLN) | % | Copper Basin | Voivodship of Lower Silesia (without the Copper Basin) | Other voivodships (without the Copper Basin and the Voivodship of Lower Silesia) | ||

| Health care | 1,480,963.67 | 99% | 172 | 131 | 17 | 24 |

| Social aid | 18,917.00 | 1% | 3 | 0 | 1 | 2 |

| Total | 1,499,880.67 | 100% | 175 | 131 | 18 | 26 |

A detailed list of donations granted to institutions is presented at http://www.fundacjakghm.pl/

Social aid

Selected GRI Standards with respect to activities involving the natural environment

Selected GRI Standards for 2018 with respect to activities involving the natural environment:

Direct and indirect energy consumption by the organization

| 1 | Total consumption of non-renewable raw materials (own or purchased) in Joules or a multiple thereof, broken down by type of raw material | Values (MWh) | |

|---|---|---|---|

| KGHM Group | KGHM Polska Miedź S.A. | ||

| Non-renewable | coal | 1622525,91 | - |

| natural gas | 2276181,32 | 2156781 | |

| heating oil | 6315,65 | - | |

| diesel fuel | 2 505 506,34 | - | |

| Total | Total consumption | 6410529,21 | 2156781 |

| 2 | Total consumption of energy from renewables (own or purchased) in Joules or multiples thereof, by type of renewable | Values (MWh) | |

|---|---|---|---|

| KGHM Group | KGHM Polska Miedź S.A. | ||

| Renewable | biomasa | - | - |

| biofuel | - | - | |

| Wind power | - | - | |

| Solar power | 302,03 | - | |

| Geothermal energy | 168 | - | |

| Water power | - | - | |

| Other (t) | - | - | |

| Total | Total consumption | 470,03 | - |

| 3 | Total consumption of energy produced or purchased, by electricity, heat in Joules or multiples thereof | Values (MWh) | |

|---|---|---|---|

| KGHM Group | KGHM Polska Miedź S.A. | ||

| electricity | 4237058,47 | 2852918 | |

| Heat (including consumption of steam, consumption of cooling energy) | 190336,23 | - | |

| Total | Energy consumption | 4427394,77 | 2852918 |

| 4 | Total energy sales: electricity, heat, cooling and steam, in Joules or multiples thereof | Values (MWh) | |

|---|---|---|---|

| KGHM Group | KGHM Polska Miedź S.A. | ||

| Total sales of electricity | 428394,24 | 340574 | |

| Total sales of heat (net) | 1584845,74 | - | |

| Total sales of cooling energy | - | - | |

| Total sales of steam | - | - | |

| Total | Sales | 2013239,98 | 340574 |

| 5 | Total energy consumption within the organization | 8825154,03 | 4669125 |

|---|

G305-2 – Indirect greenhouse gas emissions

| Indirect emissions, by source | Greenhouse gas emissions (tCO2e) | |

|---|---|---|

| KGHM Group | KGHM Polska Miedź S.A. | |

| Emissions resulting from electricity purchased for own needs | 24680643,96 | 1847663 |

| Emissions resulting from heat purchased for own needs | 520271,10 | 199981 |

| Emissions resulting from cooling energy or steam purchased for own needs | 11697,10 | - |

| Total indirect emissions | 25212612,12 | 2047644 |

G306-2 - Total weight of waste by type and disposal method

| No. | Total weight of hazardous and non-hazardous waste, by treatment method | Weight of waste in 2018 [t] | |||

|---|---|---|---|---|---|

| Waste other than hazardous waste | Hazardous waste | ||||

| KGHM Group | KGHM Polska Miedź S.A. | KGHM Group | KGHM Polska Miedź S.A. | ||

| 1 | Re-use of waste | 33 379,42 | 14 594,01 | 0 | 0 |

| 2 | Recycling (including organic recycling, e.g. composting) | 3 367,62 | 1 816,73 | 1 049,40 | 15,28 |

| 3 | Recovery (including recovery of energy) | 19 589 369,92 | 19 465 505,68 | 102 066,52 | 102 039,32 |

| 4 | Incineration (or use as fuel) | 31,39 | 0 | 217,67 | 0 |

| 5 | Storage in landfills | 30 351 832,32 | 10 310 972,89 | 77 173,43 | 73 867,20 |

| 6 | Discharge to deep wells | 0 | 0 | 0 | 0 |

| 7 | Storage on site | 234 949,63 | 228 400,11 | 78 543,83 | 77 466,91 |

| 8 | Other | 1 438,63 | 211,44 | 38 979,37 | 38 826,95 |

| TOTAL | 50 214 368,92 | 30 021 500,86 | 298 030,21 | 292 215,67 | |

G307-1 – Monetary value of fines and total number of non-monetary sanctions for non-compliance with environmental laws and regulations

| Information on administrative and judicial sanctions imposed on the organization for non-compliance with environmental legislation | ||

|---|---|---|

| KGHM Group | KGHM Polska Miedź S.A. | |

| 0 | 0 | |

Amongst the evidence confirming the effectiveness of environmental initiatives and of the reduced environmental impact of the Company’s activities is the fact that no non-financial sanctions were imposed within the KGHM Polska Miedź S.A. Group or in the Parent Entity.