Sustainable Report for 2018

KGHM Group and Our World

KGHM Polska Miedź S.A. is a global, innovative organization involved in technologically advanced exploration, mining and smelting operations. For several decades, the Company has been mining and processing valuable underground resources, providing the world with commodities that enable its sustainable development.

KGHM Group and Our World

Who we are

KGHM Polska Miedź S.A. is the Parent Entity of a Group which is a world-class producer of copper and silver with nearly 60 years of experience in the copper ore mining and processing sector. In Poland, KGHM Polska Miedź S.A. operates one of the world’s largest copper deposits, guaranteeing continuous production in Poland for the next several decades. KGHM Polska Miedź S.A. also produces silver, gold, molybdenum, lead and rock salt, as well as being one of the leading exporters in the country and one of the largest companies in Poland.

KGHM Group and Our World

Major assets

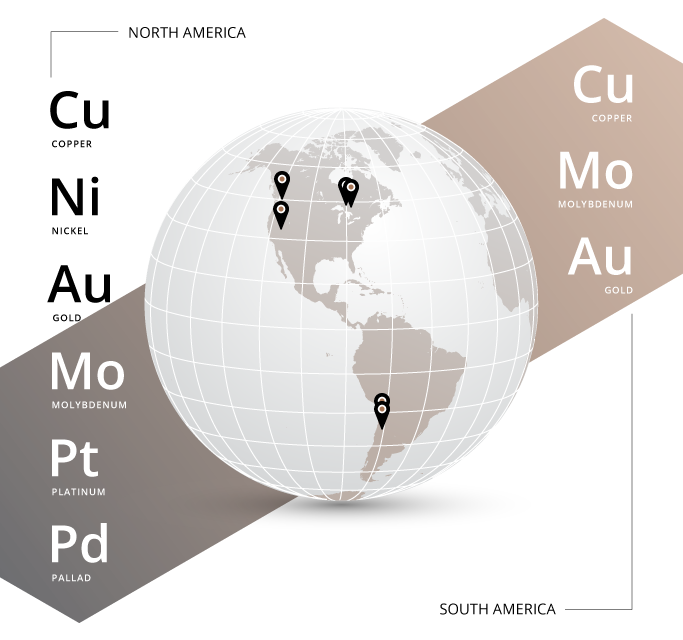

The KGHM Polska Miedź S.A. Group holds geographically diversified mining assets located in low-risk countries. The copper, silver, molybdenum, nickel and precious metals mines of the Group are located in Poland, the USA, Chile and Canada. The key international asset – the Sierra Gorda mine, which is a joint venture between KGHM INTERNATIONAL LTD., Sumitomo Metal Mining and the Sumitomo Corporation – is located in Chile. In addition, the KGHM Polska Miedź S.A. Group has mine projects which are at the preproduction phase (Victoria, Sierra Gorda Oxide, Ajax), as well as exploration projects.

The major assets of the KGHM Polska Miedź S.A. Group are presented in the diagram below.

Img. Location of mining assets of the KGHM Polska Miedź S.A. Group

Geological assets

The KGHM Polska Miedź S.A. Group strives to develop its portfolio of geological assets based on two main criteria. The first is to have a sufficiently high amount of material in ore. This enables a sufficiently high economic efficiency to be achieved from the geological assets on the materials mined in the short term. The second criteria is to have the operations based on assets having a sufficiently long mine life. This enables a sufficiently high economic efficiency to be achieved in the strategic sense, which is possible thanks to the appropriately long lives of the mining projects. This is also important for KGHM due to its high standards in the area of corporate social responsibility.

For these reasons, as well as due to the question of the sources of mining resources, which is of fundamental importance, KGHM attempts to locate its activities in globally-recognised mining jurisdictions, which at the same time are often the largest such resources in a given part of the world. Based on these criteria the current portfolio of geological assets held by KGHM has been built and is successively developed.

The polymetallic deposits situated in Poland on the Fore-Sudetic monocline and in the North Sudetic trough, for which KGHM either holds exploration and mining concessions or is in the process of acquiring them, are some of the richest and most potentially valuable deposits of copper, silver and other metals in Europe, representing the basis for the mining operations of KGHM Polska Miedź S.A. for the next 35 years.

These deposits are located in the vicinity of the towns of Lubin and Polkowice, and include areas reaching to Głogów, Bytom Odrzański and Luboszyce. As a result of the mining over the past decades of a Zechstein salt deposit which lies above the layer of polymetallic deposits, KGHM has also developed its skills in the exploration for and mining of salt deposits.

The geological assets of the KGHM Polska Miedź S.A. Group in South America and North America not only form part of the reservoir of copper assets for growth, but likewise for developing the skills of the Group in the mining and processing of metals both now and in the decades to come.

KGHM Group and Our World

Mining and metallurgical assets

Based on the aforementioned geological assets, mines and metallurgical plants have been established and developed. These are described below in the subsequent tables:

Poland

Poland

Polkowice -

Sieroszowice mine

Polkowice-Sieroszowice mine | |

|---|---|

| Location: | Lower Silesia, Poland |

| Ownership: | KGHM Polska Miedź S.A. Division |

| Type of mine: | underground |

| Main ore type: | copper ore |

| Associated metals: | silver, lead, rock salt, gold |

| Type of orebody: | stratiform |

| End product: | copper ore |

Copper in extracted ore in 2018 | 195.7 thousand tonnes |

The Polkowice-Sieroszowice mine is located in Lower Silesia, to the west of the town of Polkowice. Currently, it conducts mining works in four mining areas: Polkowice, Radwanice Wschodnie, Sieroszowice and in a part of the Głogów Głęboki – Przemysłowy (Deep Głogów) deposit.

Within the Sieroszowice deposit, there are also rich deposits of rock salt above the copper-bearing horizon.

Mining is conducted using room-and-pillar methods with natural roof settlement, using blasting technology. The Polkowice-Sieroszowice mine’s current production capacity is around 12 million tonnes of ore per year.

Rudna mine | |

|---|---|

| Location: | Lower Silesia, Poland |

| Ownership: | KGHM Polska Miedź S.A. Division |

| Type of mine: | underground |

| Main ore type: | copper ore |

| Associated metals: | silver, lead, gold |

| Type of orebody: | stratiform |

| End product: | copper ore |

Copper in extracted ore in 2018 | 186.2 thousand tonnes |

Poland

Rudna mine

The Rudna mine is located in Lower Silesia, to the north of the town of Polkowice. It mines the copper deposit in Rudna mining area as well as in parts of the mining areas of Sieroszowice, Lubin-Małomice and Głogów Głęboki-Przemysłowy (Deep Głogów).

The copper orebody in the currently mined deposit ranges from 844 meters to 1250 meters. Mining is conducted using room-and-pillar methods with natural roof settlement with hydraulic backfill, using blasting technology. The current average production capacity is approx. 12 million tonnes of ore per year.

Poland

Lubin mine

Lubin mine | |

|---|---|

| Location: | Lower Silesia, Poland |

| Ownership: | KGHM Polska Miedź S.A. Division |

| Type of mine: | underground |

| Main ore type: | copper ore |

| Associated metals: | silver, lead, gold |

| Type of orebody: | stratiform |

| End product: | copper ore |

Copper in extracted ore in 2018 | 70.1 thousand tonnes |

The Lubin mine is located in Lower Silesia, Poland, to the north of the town of Lubin. The mines the copper deposit in the mining area Lubin-Małomice at a depth from 368 meters to 1006 meters.

Mining is conducted using room-and-pillar methods with natural roof settlement with hydraulic backfill, in the vicinity of the support pillar of the town of Lubin, using blasting technology.

The mine’s current production capacity is around 8 million tonnes of ore per year.

Głogów Copper Smelter and Refinery | |

|---|---|

| Location: | Lower Silesia, Poland |

| Ownership: | KGHM Polska Miedź S.A. Division |

| Type of metallurgical plant: | smelter/refinery |

| End product: | electrolytic copper |

Electrolytic copper production in 2018 | 387.3 thousand tonnes |

Poland

Głogów Copper Smelter and Refinery

This complex of metallurgical plants located in Głogów comprises two copper concentrate smelting lines based on the one-stage smelting of concentrate in a flash furnace directly into blister copper. Apart from electrolytic copper, the Głogów Copper Smelter and Refinery produces crude lead (up to 30 thousand tonnes annually), silver (around 1200 tonnes), gold (around 2.6 tonnes) and sulphuric acid (over 507 thousand tonnes).

Poland

Legnica Copper Smelter and Refinery

Legnica Copper Smelter and Refinery | |

|---|---|

| Location: | Lower Silesia, Poland |

| Ownership: | KGHM Polska Miedź S.A. Division |

| Type of metallurgical plant: | smelter/refinery |

| End product: | electrolytic copper |

Electrolytic copper production in 2018 | 114.5 thousand tonnes |

The copper smelter and refinery located in Legnica has a current production capacity of 120 thousand tonnes of electrolytic copper. In operation since the 1950s based on shaft furnace technology. Apart from electrolytic copper, the plant also produces round billets, around 30 thousand tonnes annually of refined lead and also 115 thousand tonnes of sulphuric acid, as well as copper sulphate and nickel sulphate.

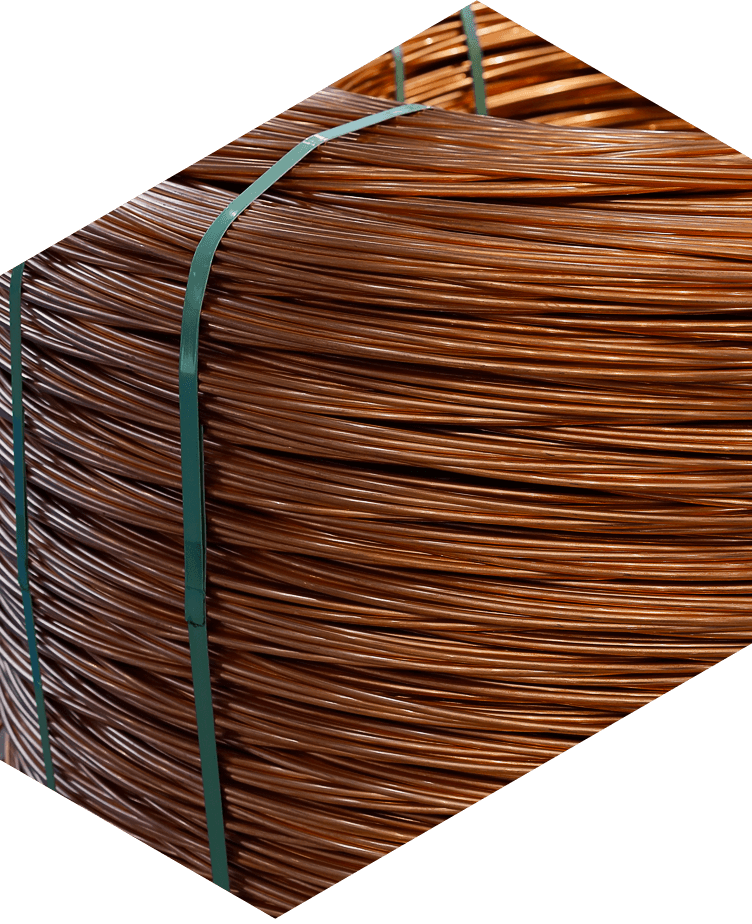

Cedynia Wire Rod Plant | |

|---|---|

| Location: | Lower Silesia, Poland |

| Ownership: | KGHM Polska Miedź S.A. Division |

| Type of metallurgical plant: | processing |

| End product: | copper wire rod and Cu-OFE rod |

Production in 2018 | 248.8 thousand tonnes of copper wire rod and 17.6 thousand tonnes of OFE rod |

Poland

Cedynia Wire Rod Plant

Production at the Cedynia Wire Rod Plant located in the vicinity of Orsk is based on the use of copper cathodes, 75% of which come from the Głogów Copper Smelter and Refinery and 25% from the Legnica Copper Smelter and Refinery. The basic product of the Cedynia Wire Rod Plant is copper wire rod produced in a Contirod line amounting to around 250 thousand tonnes annually and around 18 thousand tonnes annually of oxygen-free copper wire rod (OFE) produced in a UPCAST line, including oxygen-free, silver-bearing copper wire rod.

The United States

The United States

Robinson mine

Robinson mine | |

|---|---|

| Location: | Nevada, USA |

| Ownership: | 100% KGHM INTERNATIONAL LTD. |

| Type of mine: | open pit |

| Main ore type: | copper ore |

| Associated metals: | gold and molybdenum |

| Type of orebody: | porphyry / skarn |

| End product: | copper and gold concentrate, molybdenum concentrate |

Payable copper production in 2018 | 48.0 thousand tonnes |

The mine is located in White Pine county, Nevada, USA, around 11 km west of Ely (approx. 400 km north of Las Vegas), in the Egan range, at an average altitude of 2130 meters a.s.l., near highway no. 50.

The mine is comprised of 3 large pits: Liberty, Tripp-Veteran and Ruth. Currently, Ruth is in operation. The ore is extracted by conventional methods, and is then processed into a copper and gold concentrate, and separately into molybdenum concentrate in a concentrating plant.

Carlota mine | |

|---|---|

| Location: | Arizona, USA |

| Ownership: | 100% KGHM INTERNATIONAL LTD. |

| Type of mine: | open pit |

| Main ore type: | copper ore |

| Type of orebody: | porphyry |

| End product: | copper cathodes |

Payable copper production in 2018 | 3.2 thousand tonnes |

The United States

Carlota mine

The Carlota mine is located in the Western part of the Miami-Globe mining region, in the state of Arizona at an altitude of 1 300 meters (4 200 feet) a.s.l. Surrounding the mine is mountainous, desert terrain.

Copper ore extraction by the Carlota mine is by conventional methods typical for open-pit metals mines, i.e. the ore is mined by blasting and then is transported by haulage trucks. In 2018 mining re-commenced in the Eder South area.

Canada

Canada

Sudbury Basin

Sudbury Basin | |

|---|---|

| Location: | Sudbury, Ontario, Canada |

| Ownership: | 100% KGHM INTERNATIONAL LTD. |

| Type of mine: | underground |

| Main ore type: | copper ore, nickel, platinum, palladium and gold |

| Type of orebody: | footwall/contact Ni |

| End product: | copper ore and nickel |

Payable copper production in 2018 | 7.4 thousand tonnes |

The Sudbury Basin is located in central Ontario in Canada, approx. 400 km north of Toronto. In this region KGHM INTERNATIONAL LTD. owns a variety of assets extracting copper and nickel ore along with precious metals. Amongst the most important assets are the Morrison/Levack and McCreedy West underground mines, utilising the Craig and Levack shafts and an adit. Extraction is through mining methods which are dependent on the geometry of the deposit – mainly a mechanised method of selective extraction using undercutting of successive levels from bottom to top at various mine levels. All of the ore extracted from the mine is processed in the Clarabelle plant in Sudbury, owned by Vale.

Victoria project | |

|---|---|

| Location: | Sudbury Basin, Ontario, Canada |

| Ownership: | 100% KGHM INTERNATIONAL LTD. |

| Type of mine: | underground |

| Main ore type: | copper-nickel ore |

| Associated metals: | gold, platinum and palladium |

| Mine life: | 13 years |

| End product: | copper, nickel and precious metals ore |

Forecasted annual production | 17 thousand tonnes Ni, 19 thousand tonnes Cu |

Canada

Victoria project

This project is located in the Canadian province of Ontario, around 35 km west of the town of Sudbury. In 2002 rights were acquired to the Victoria mineral deposit and a campaign of exploration in this region commenced. All of the ore extracted from the mine will be processed in the Clarabelle plant in Sudbury, owned by Vale. The current development scenario for the project calls for the sinking of 2 shafts to access the deposit (a production shaft and a ventilation shaft). Exploration work performed thus far confirmed the continuity and characteristics of the mineralisation to the level of approximately 2200 meters below the surface.

Based on analytical work performed in 2017, the base scenario assumes the Victoria project will be developed in two stages, comprised of the sinking of a first shaft along with additional exploration, followed by a second shaft for production.

In 2018, required permits for the project were reviewed and work commenced on preparing necessary applications, mainly with respect to planned work related to the construction of selected elements of the project’s infrastructure. The project team conducted work related to securing existing infrastructure and project terrain, the administrative and legal development of the project and maintaining relations with First Nations in Ontario, Canada.

Canada

Ajax

project

Ajax project | |

|---|---|

| Location: | Kamloops, British Columbia, Canada |

| Ownership: | KGHM INTERNATIONAL LTD. 80%; Abacus Mining and Exploration Inc. 20% |

| Type of mine: | open pit |

| Main ore type: | copper ore |

| Associated metals: | precious metals (gold and silver) |

| Mine life: | 19 years |

| End product: | copper concentrate |

Forecasted annual production | 53 thousand tonnes Cu, 114 thousand ounces Au |

The Ajax project is located in British Columbia, Canada, 400 km north-east of Vancouver near the town of Kamloops. The project assumes the construction of an open-pit copper and gold mine and an ore processing plant, with associated infrastructure. In January 2012, the company Abacus Mining and Exploration Inc. prepared a feasibility study, based on which the preliminary economic parameters of this project were described. Due to the substantial risk of not receiving environmental permit based on the assumed technological parameters of the project, including the siting of basic mine plant infrastructure, the assumptions of the feasibility study from 2012 were reviewed in terms of identifying risk factors and the potential for increasing the project’s value.

In January 2016, an Updated Feasibility Study was published, replacing the earlier version dated 6 January 2012. The Updated Feasibility Study reflects changes to the project, under which the mine’s infrastructure was moved farther from the nearest buildings in the town of Kamloops, technology improvements were incorporated and the processing facility’s throughput capacity was increased from 60 to 65 thousand tonnes of ore per day.

In December 2017, the Ministers of Environment and of Energy, Mines and Petroleum Resources of British Columbia (provincial authorities) decided against the granting of an Environmental Assessment Certificate for the Ajax project. In June 2018, the Government of Canada, through the Governor-in-Council (Cabinet) issued a negative decision regarding the Ajax project as the project is likely to cause significant adverse environmental effects.

The decisions were made through the environmental impact assessment process, and reflect the substantial engagement of provincial and federal governmental agencies, First Nations and a broad spectrum of stakeholders, including thousands of local citizens.

In 2018, work was carried out related to requisite monitoring and securing existing infrastructure.

Chile

Chile

Sierra

Gorda

Sierra Gorda mine and Sierra Gorda Oxide project | |

|---|---|

| Location: | Region II, Chile |

| Ownership: | 55% KGHM INTERNATIONAL LTD, 45% Sumitomo Group companies: - Sumitomo Metal Mining Co., Ltd. (31.5%) - Sumitomo Corporation (13.5%) |

| Type of mine: | open pit |

| Main ore type: | copper ore |

| Associated metals: | molybdenum, gold |

| Mine life: | 25 years for the current deposit based on phase I of the investment, including actions to remove bottlenecks. Moreover, there is a possibility to extend the mine’s life using new deposits. |

| End product: | copper concentrate, molybdenum concentrate |

Payable production in 2018 | 96.9 thousand tonnes of copper in concentrate, 26.7 million pounds of molybdenum in concentrate – on a 100% basis, share of KGHM Polska Miedź S.A. is 55%. |

The Sierra Gorda mine is located in the Atacama desert, in the Sierra Gorda administrative area in the Antofagasta region, in northern Chile, approx. 60 km south-west of the city of Calama. The mine is situated at an altitude of 1 700 meters a.s.l. and 4 km from the town of Sierra Gorda.

The ore mined in the Sierra Gorda mine is processed into copper and molybdenum concentrates.

In April 2015 the molybdenum installation commenced production, and from 1 July 2015 the Sierra Gorda mine has commenced commercial production (since then it has prepared statements of profit or loss). In 2018, work was carried out related to optimising the processing of the sulphide ore. The actions taken were aimed at stabilising the volumes and technological parameters of ore processing, as well as stabilising the work of the processing plant and increasing metals recovery.

At present work is aimed at developing the mine based on phase I of the investment along with actions aimed at optimising the production line, which should lead to increased production capacity.

The Sierra Gorda Oxide project involves the leaching of the copper oxide ore of Sierra Gorda on a permanent heap and the production of high-quality copper cathodes SX-EW installation, over a period of 10 years. Average copper production will be approx. 30 thousand tonnes/year. Most of the oxide ore assumed for the project is currently stored, near the site of the planned heap, on the grounds of the Sierra Gorda mine. In 2018, work was carried out aimed at minimising potential project risk and increasing its efficiency, mainly by analysing the option of preliminary crushing of the ore prior to the process of leaching. This analysis included crushing tests. In addition, tests involving the leaching of the crushed ore in columns were carried out. Preliminary verification of the procedure related to altering the project’s permits was also carried out.

Franke mine | |

|---|---|

| Location: | Antofagasta Region, Chile |

| Ownership: | 100% KGHM INTERNATIONAL LTD. |

| Type of mine: | open pit |

| Type of orebody: | IOCG (ore type containing iron, copper and gold) |

| Mine life:: | 13 years |

| End product: | copper cathodes |

Payable copper production in 2018 | 20.2 thousand tonnes |

Chile

Franke

mine

The mine is located in a desert area of northern Chile, in the Altamira region, near the southern boundary of the Antofagasta region, near a public road connecting the mine with the Pan-American highway.

Mining is conducted by conventional open-pit methods. Due to the nature of the ore, it is processed using the heap leach, solvent-extraction and electrowinning method. The end product is electrolytic copper in the form of cathodes.

KGHM Group and Our World

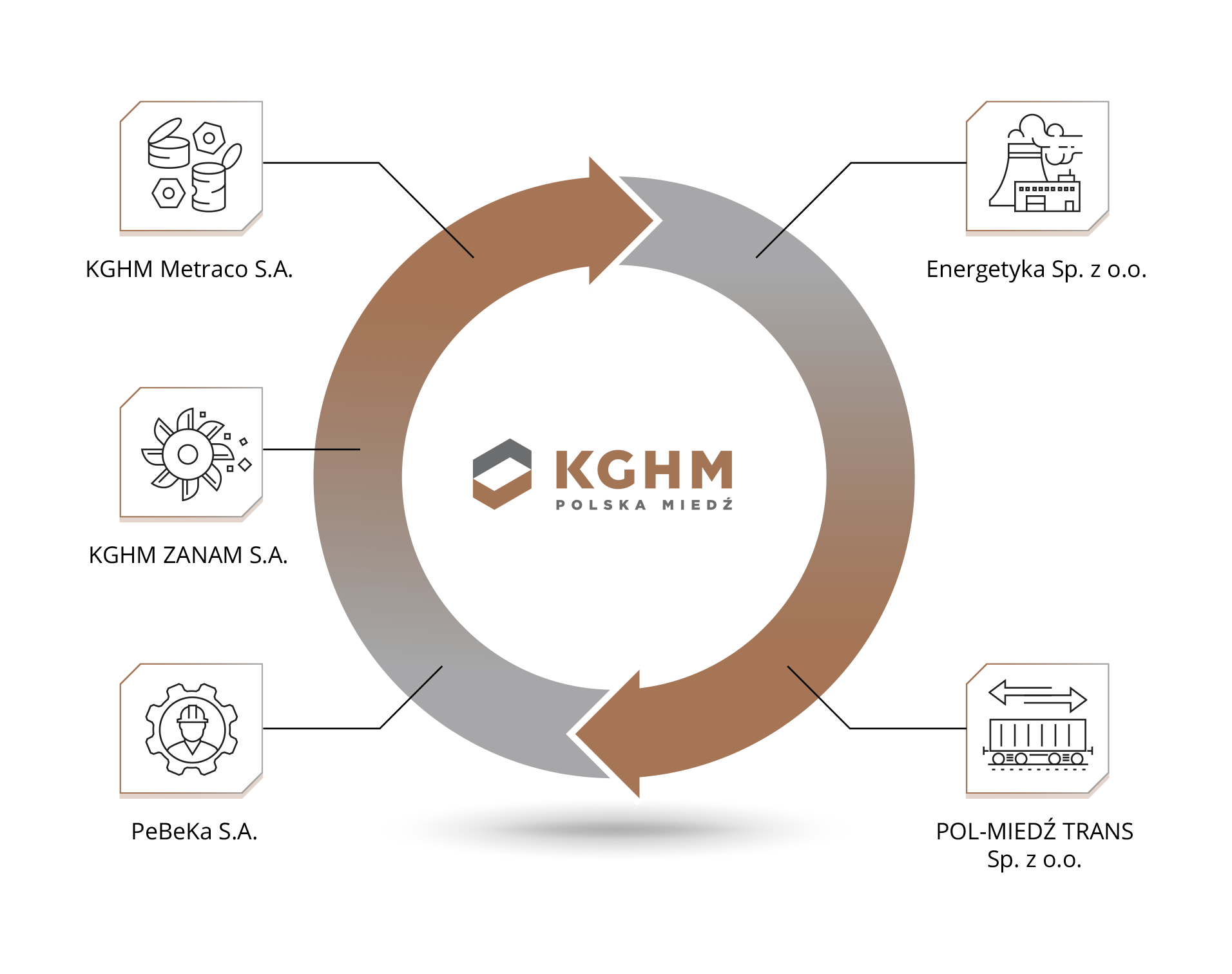

Other assets

In terms of assuring the operations of the core business of KGHM Polska Miedź S.A., of significance are investments in domestic companies acting on its behalf, such as:

- PeBeKa S.A. – mining work contractor,

- KGHM ZANAM S.A. – a supplier and service provider for mining machinery, and also provides production maintenance services in selected areas and participates in investment tasks,

- KGHM Metraco S.A. – a supplier of copper scrap,

- „Energetyka” sp. z o.o. – this company secures part of the energy needs of KGHM Polska Miedź S.A.

- Pol-Miedź Trans - matters of concentrate transport and copper itself.

In terms of the amount of capital committed, an important investment are also the shares of TAURON Polska Energia S.A., a company listed on the Warsaw Stock Exchange.

Investments in closed-end investment funds are a tool used to diversify the investment risk for KGHM Polska Miedź S.A. In advancing the strategy of the Group, they fill a role in the management of selected non-core assets and are a tool in the advancement of projects aimed at increasing value. A significant portion of these funds’ assets are investments in the general field of health.

In addition, amongst the international companies is a group of companies under the DMC Mining Services brand: FNX Mining Company Inc., Raise Boring Mining Services S.A. de C.V., DMC Mining Services Corporation, DMC Mining Services Colombia S.A.S. and DMC Mining Services (UK) Ltd., which provide services in shaft sinking, mine development work, above-ground and underground mine facilities, mine drilling, tunnel drilling for general construction purposes and engineering services.

Mission

To Always

have copper

KGHM Group and Our World

Our mission, vision and values

Our mission and vision

We believe that copper and the other minerals that we provide to our customers on every continent are, and will remain, critical for the development of all sectors in the foreseeable future. For this reason our mission is „To always have copper” with the vision „To use our resources efficiently to become a leader in sustainable development”. The principle of conducting our business in compliance with the concept of sustainable development and of being a leader in this regard is based on numerous factors. Among them it is worth pointing out the scale and multi-faceted nature of our business and the long life of the Group. This in turn generates a substantial, conscious sense of responsibility for the rational, balanced utilisation of our resources, as well as for the Group’s enormous impact on its environment, mainly in its social and natural aspects.

Our values

KGHM’s values bind all employees, regardless of their position in the organization or nationality, and are a guidepost for all decisions and actions taken.

KGHM is a Company with nearly 60 years of history, operating on the basis of deeply rooted values and principles which employees follow in their daily work. Zero harm, teamwork, results driven, accountability and courage – these values bind all KGHM employees, regardless of whether they work in a mine, processing plant or smelter, in Poland or in other parts of the world. KGHM builds its global position in the world as a reliable producer, trusted business partner and a company pursuing a sustainable development policy. All those values must co-exist, which is reflected in the diagram below.

In KGHM Polska Miedź S.A. we act in accordance with the following principles based on specific values:

Picture. The Group’s Basic Ethical Standards

KGHM Polska Miedź S.A. pursues the values presented above based on ethical standards. The fundamental ethical standards are shown in the diagram below.

Key Ethical Standards translating into principles of conduct in KGHM Polska Miedź S.A.

The Good of Humanity

The individual, as the key and most important capital, deserves particular care and remains at the center of attention of the Company’s bodies. KGHM Polska Miedź S.A. has set itself the goal of building an organisational culture whose foundation is based upon the shaping of relations founded on absolute respect for an employee’s rights and personal welfare, regardless of the place of employment and professional status.

The Good of the Company

We look after the good of the KGHM Group, endeavouring to ensure the stable growth of its companies, uninterrupted production and to counter the risk of losses.

The Good of our Stakeholders

Solid relations with stakeholders, based on mutual understanding and trust, are of key importance for KGHM Polska Miedź S.A. as an organisation which has a substantial impact on its economic, social and natural environments.

The Group’s Basic Ethical Standards, which are followed based on the principles of ethical behaviour, are shown in the following diagram:

Principles of ethical behaviour in KGHM Polska Miedź S.A

Picture. Principles of ethical behaviour in KGHM Polska Miedź S.A

The communication and implementation of Ethical Standards in KGHM Polska Miedź S.A. is facilitated by a system of codes, policies and procedures, introduced and maintained by appropriately trained representatives and committees. Their implementation satisfies global corporate governance standards and the increasing expectations of our Stakeholders. Based on the aforementioned, best corporate governance practices, principles, policies and instructions are followed by the Company which introduce global, consistent standards, adapted to regulations existing in all of the jurisdictions in which KGHM Polska Miedź S.A. operates. Advancement of the mission, vision and principles adhered to by the KGHM Polska Miedź S.A. Group is based on the distribution and appropriate management of capital.

KGHM Group and Our World

Competitive advantages of the KGHM Polska Miedź S.A.

The scope of the KGHM Polska Miedź S.A. Group’s business operations, the unique, on a global scale, comprehensiveness of our mining and processing operations, our pursuit of innovation and maintenance of financial stability along with our extensive in-depth experience allow us to market products that satisfy the expectations of even the most demanding buyers of our products and services.

The KGHM Polska Miedź S.A. Group’s competitive advantages are depicted on the following diagram.

Global reach of its operations

In the 21st century, KGHM Polska Miedź S.A. has become a global miner active on four continents. On one hand, the magnitude of our operations substantially curtails the risk of disturbance in the continuity and quality of production, while on the other hand, it facilitates the continual transfer of knowledge and experience between its various units. Its mobility policy enables it to post the Company’s most prominent experts wherever their expert knowledge is needed to derive business benefits. That also leads to the diversification and enlargement of its product portfolio.

Unique competences and skills

During its more than 60 years of history, KGHM Polska Miedź S.A. has acquired experience, knowledge and skills that have enabled the Company to transform its business from a local miner into an international Group acting as a major player in the global market for non-ferrous metals. The skills developed by our employees are and will be used in the future as one of the fundamental assets for winning a competitive edge in the industry and for building the position of Poland as a strong industrial center. Also unique is the KGHM Polska Miedź S.A. Group’s complete business chain: from the exploration of deposits, accessing them, mining, manufacturing mining machinery and explosives, processing, smelting and refining and sales to recycling, all the while keeping in mind during the execution of these processes the principles of sustainable development and corporate social responsibility.

An integrated process, from mining to sales

Also unique is the entire core business operated by the KGHM Polska Miedź S.A. Group, from exploration for deposits through their mining and metals processing, together with the production of mining machinery and explosives, sales and recycling, reflecting in these processes sustainable development and corporate social responsibility.

Innovation

Innovation is one of the competitive advantages of the KGHM Polska Miedź S.A. Group. Work on innovative solutions is conducted at various business levels, drawing on cooperation with independent entities while appreciating the potential and ingenuity of our own employees. They are the most familiar with our specific needs and are able to identify areas and solutions that translate into better performance and greater safety.

Financial stability

Ensuring financial stability is one of the pillars of growth for the Group. The efforts of KGHM Polska Miedź S.A. to enhance its competitive advantage in this regard is aimed at basing the Group’s financing structure on long term instruments, shortening the cash conversion cycle and efficient management of market and credit risk.

The efforts made to enhance competitive advantage would not be possible were it not for the cooperation of our Stakeholders.

KGHM Group and Our World

Our stakeholders

A good relationship with stakeholders based on mutual understanding and trust is of crucial importance to the KGHM Polska Miedź S.A. Group as an organization exerting a significant impact on its economic, social and natural environment, of which it is fully aware and for which it is prepared to accept full responsibility. Cooperation – one of the Company's values – is the basis for its success in business and the social sphere. The Group builds relationships with stakeholders based on partnership and complete transparency, with an awareness of their importance in its long-term strategy and sustainable approach to business. The basis of this process is dialogue geared towards learning about mutual expectations and capabilities and implementing agreements.

In 2016, the process of identifying and mapping the KGHM Polska Miedź S.A. Group's stakeholders was conducted. Its first stage was to distinguish stakeholder groups. This was accomplished using a survey covering members of senior management of each member of the KGHM Polska Miedź S.A. Group representing various business areas. During the second stage of this process involving a validation workshop, these same respondents assessed the degree of stakeholders’ interest and orientation on the organization and vice versa. Their assessments made it possible to specify four Stakeholder groups. The key stakeholders, forming the KGHM Polska Miedź S.A. Group’s most influential and significant stakeholder group, are one of them. During a strategic review performed in 2018, it was concluded that the stakeholder map and the strength of interest and influence determined during the mapping exercise in 2016 remained unchanged for the years 2019-2023. The map is presented in the diagram below.

IMG. Key Stakeholders in the KGHM Polska Miedź S.A. Group

Good cooperation with our Stakeholders enables the KGHM Polska Miedź S.A. Group to assess, understand and shape its environment in the best possible way.

KGHM Group and Our World

Competitive environment in 2018

Based on estimates of CRU International, global mined copper production in 2018 amounted to 20 917 thousand tonnes. During this same time the companies of the KGHM Group produced in total 521 thousand tonnes of mined copper, representing approx. 2.5% of global production. In terms of the ranking of the world’s major mined copper producers, the KGHM Group held eighth place in 2018, as shown below:

| No. | Top 10 - mined copper producers | Production 2018 (kmt) |

|---|---|---|

| 1. | Codelco | 1 771 |

2. | Freeport-McMoRan | 1 440 |

3. | Glencore | 1 344 |

4. | BHP | 1 105 |

5. | Grupo Mexico | 892 |

6. | Rio Tinto | 674 |

7. | First Quantum | 567 |

| 8. | KGHM | 521 |

| 9. | Antofagasta | 498 |

| 10. | Norilsk | 476 |

Source: CRU, KGHM Polska Miedź S.A.

Global refined copper production, according to data from CRU, amounted to 23 651 thousand tonnes. Production of refined copper by the companies of the KGHM Group amounted to 522 thousand tonnes, or approx. 2.2% of global production and puts the Group beyond the top ten largest producers. However, in the ranking of the largest copper-producing countries, Poland held tenth place, as shown below:

| No. | Top 10 - refined copper-production countries | Production 2018 (kmt) |

|---|---|---|

| 1. | China | 9 405 |

2. | Chile | 2 499 |

3. | Japan | 1 556 |

4. | DR Congo | 1 021 |

5. | Russia | 997 |

6. | USA | 995 |

7. | Sth. Korea | 670 |

| 8. | Germany | 592 |

| 9. | India | 550 |

| 10. | Poland | 495 |

Source: CRU, KGHM Polska Miedź S.A.

In 2018, global mined silver production in amounted to 856 million troy ounces (estimated data by the World Silver Survey). The KGHM Polska Miedź Group during this time produced 33.9 million troy ounces of silver, representing approx. 4.0% of global production of this metal. According to the survey conducted annually by the World Silver Survey, in 2018 the KGHM Group held third place globally in terms of metallic silver production, while Poland held seventh place in the ranking of countries producing this precious metal, as shown below:

| No. | Top 10 - silver producers | Production 2018 (kmt) |

|---|---|---|

| 1. | Fresnillo plc. | 1 807 |

2. | Glencore plc. | 1 086 |

3. | KGHM Polska Miedź S.A. (Group) | 1 054 |

4. | Cia. De Minas Buenaventura S.A.A. | 815 |

5. | Polymetal International plc. | 787 |

6. | Pan American Silver Corp. | 771 |

7. | Goldcorp Inc. | 762 |

| 8. | Hochschild Mining plc. | 613 |

| 9. | Hindustan Zinc Ltd. | 610 |

| 10. | Southern Copper Corp | 538 |

Source: GFMS World Silver Survey, Thomson Reuters, KGHM Polska Miedź S.A.

| No. | Top 10 - silver producing countries | Production 2018 (kmt) |

|---|---|---|

| 1. | Maxico | 6 115 |

2. | Peru | 4 507 |

3. | China | 3 574 |

4. | Russia | 1 350 |

5. | Chile | 1 309 |

6. | Bolivia | 1 241 |

7. | Poland | 1 232 |

| 8. | Australia | 1 101 |

| 9. | USA | 871 |

| 10. | Argentina | 824 |

Source: GFMS World Silver Survey, Thomson Reuters, KGHM Polska Miedź S.A.

KGHM Group and Our World

2018 macroeconomic environment

From analyses conducted by the International Monetary Fund it appears that, although in 2018 the global economy was unable to maintain the rate of growth recorded in 2017, it still provided room for optimism. We can no longer speak about synchronised growth, given the clear acceleration in the United States and the weakening of the Eurozone, as detailed in the following diagram:

Source: Bloomberg, KGHM Polska Miedź S.A.

This trend is confirmed by the newest global GDP readings, which according to estimates of the IMF amounted to 3.6% in 2018 (3.8% in 2017). As a result the global economy only slowed slightly, which to a large extent was due to weaker results in the second half of the year. This was confirmed by readings from both emerging economies as well as from developed ones. The weaker readings lead the IMF to a slight revision of its global GDP growth forecast in 2019 to 3.3% (0.2 percentage points lower than in the prior forecast). The forecasted growth in 2020 remains unchanged at 3.6%. This is shown in detail in the following diagram:

Source: IMF, KGHM Polska Miedź S.A.

The global slowdown observed in the second half of 2018 was caused by several factors. Economic growth in China was lower due to a combination of regulatory tightening related to so-called shadow banking and heightened tensions with the USA. The slowdown in the Eurozone turned out to be more pronounced than expected and involved interruptions in automobile production in Germany, a drop in investments in Italy and lower internal demand. Sentiment in the financial markets was lower, leading in the spring of 2018 to weaker financial results in emerging markets, and later in the year in developed economies as well.

Another several years of price declines in the commodities markets affected investments in many companies and frequently lead to problems with with liquidity. This trend was however interrupted at the end of 2016, and the rise in prices of many metals from that time lasted until mid-2018. Investor and analyst optimism was mainly based on strong fundamentals, the result among others of many years of under-investment, with a consequent impact on supply. On the other hand the relatively strong economic growth in key global economies, in particular the USA and China, had a positive impact on commodities consumption. Sentiment changed however at mid-year, as a result of the introduction of tariffs under the growing trade conflict between the United States and China. Apart from the shadow this cast on trade with China, the world’s largest consumer of copper, it also lead to a substantial appreciation of the USD. The value of the USD compared to a basket of currencies (the so-called dollar index) in 2018 rose by nearly 4.5%, aided likewise by a tighter monetary policy by the Fed, despite the opposition of President Trump and the growing disparity between the USA and the world’s main economic regions. These were the main factors which lead to a rapid depreciation in commodities prices from June 2018.

The tense political situation in 2018 and the strengthening of the USD had a negative impact not only on metals prices but also on most other commodities. On a yearly scale the Bloomberg Commodity Index (BCOM) fell by nearly 15% which, apart from its impact on metals prices, was the factor most responsible for the depreciation in the value of energy-related commodities (-18%) and industrial commodities (-21%). This is shown in detail in the following drawing:

Source: Bloomberg, KGHM Polska Miedź S.A.

Market conditions in 2018

In 2018 the refined copper market was in deficit, caused mainly by many years of under-investment in new mining projects, which restricted supply, as well as by a steady increase in demand in China. Although the expected scenario of multiple supply-side interruptions, based on the need to renegotiate labour contracts and the associated potential for strikes in numerous mines, failed to materialize, the increase in mine production, considering the low base of 2017, nonetheless remained relatively low (3.7% as compared to 4.7% in the period 2012-2016). Hope on the part of market participants was also supported by the potential for additional demand from the electric car sector, despite the fact that this growth will only become noticeable in the long term. However, this situation drastically reversed at mid-year, when the risk of a trade war between the United States and China began to materialize. As a result, on the day prior to the introduction by the administration of President Trump of tariffs amounting to USD 34 billion on Chinese exports to the USA, one of the largest Chinese brokers – Gelin Dahua – closed most of the positions they had opened in January 2019 and part of those from November and December 2018. This initiated a rapid collapse in the copper price, which within barely a month fell from around 1 000 USD/t. The price of copper in the second half of the year stabilised around 6 100 USD/t. Consequently, the average price of copper in the second half of 2018 was more than 11% lower than in the first half.

The average annual price of copper on the London Metal Exchange (LME) in 2018 was 6 523 USD/t, 6% above the average price in 2017 (6 166 USD/t).

The strengthening of the USD in the second half of 2018 led to a fall in the silver price below 14 USD/oz t in September 2018, or the lowest level since January 2016. In subsequent months, despite the numerous threats to the stability of the global economy, assets generally considered as safe were not particularly in demand by investors. Only in the final weeks of the year did the downturn on the US stock market and the growing expectations of a slowdown in the policy of monetary easing by the Fed led to growth on the precious metals market, which continued into the first weeks of 2019. The price of silver ended 2018 at the level of 15.47 USD/oz t.

The average price of silver according to the London Bullion Market Association (LBMA) fell in 2018 by 8% and averaged 15.71 USD/oz t as compared to 17.05 USD/oz t in 2017.

The average annual price of nickel on the LME in 2018 amounted to 13 122 USD/t and was 26% higher than the average price recorded in 2017 (10 411 USD/t), and at the end of the year amounted to 10 595 USD/t. The level of 15 000 USD/t, the highest since 2015, was reached in June, on a wave of fears that American sanctions would seriously impact Russian metal producers, and at the same time severely limiting supply. However, in the second half of 2018, following many of the other base metals, the price of nickel began to fall, mainly due to fears about the condition of the Chinese economy under the impact of American tariffs. The price of nickel nonetheless remains supported by solid market fundamentals and by potential growth in demand for the metal from the dynamically developing electric vehicles battery sector. On the other hand, a more dynamic increase in prices was slowed by the still-high global inventories of this metal.

In the first half of 2018, following many of the other base metals, the price of molybdenum was also pushed up, with significant increases in this period. After a temporary price collapse in the June-July timeframe, the price again rose above 12 USD/lb and remained at this level until the end of the year. The price of molybdenum was supported by the fundamental market situation and by falling production in the Chuquicamata mine (related to the transformation of this mine from open-pit to underground), which was partially offset by higher production in other mines in Latin America. The steel industry, which is crucial for molybdenum, despite weaker results in Europe, continues to generate substantial demand for this metal in the United States and China. The average monthly price of molybdenum during the year ranged between 10.85 USD/lb (January 2018) and 12.86 USD/lb (March 2018).

As a result, the average price of this metal in 2018 amounted to 12.14 USD/lb and was more than 48% higher than the average price in 2017 (8.22 USD/lb).

The USD in 2018 strengthened substantially as compared to other world currencies – the value of the USD as compared to the currency basket (the so-called dollar index) increased by more than 4%. This appreciation of the USD was driven by the continued tightening of monetary policy by the Fed and the continued positive readings from the US economy. The USD/PLN exchange rate, after reaching its lowest level since 2014 (around 3.35 USD/PLN) at the turn of January and February 2018, saw a dynamic increase in the second quarter of the year, and at the end of 2018 reached the level of 3.76 USD/PLN. The average USD/PLN exchange rate (per the NBP) in 2018 amounted to 3.6117 USD/PLN and was lower by 4% than the rate in 2017 (3.7782 USD/PLN).

The following table presents the most important macroeconomic data for the Company’s operations:

Macroeconomic factors significant for the operations of the KGHM Polska Miedź S.A. Group – average prices

| Unit | 2018 | 2017 | Change (%) | 4Q'18 | 3Q'18 | 2Q'18 | 1Q'18 | |

|---|---|---|---|---|---|---|---|---|

| Copper price on the LME | USD/t | 6 523 | 6 166 | +5,8 | 6 172 | 6 105 | 6 872 | 6 961 |

| Copper price on the LME in PLN | PLN/t | 23 520 | 23 212 | +1,3 | 23 255 | 22 609 | 24 581 | 23 669 |

| Silver price per the LBMA | USD/oz t | 15,71 | 17,05 | (7,9) | 14,54 | 15,02 | 16,53 | 16,77 |

| Nickel price on the LME | USD/t | 13 122 | 10 411 | +26,0 | 11 516 | 13 266 | 14 476 | 13 276 |

| Molybdenum price per the CRU | USD/lb | 12,14 | 8,22 | +47,7 | 12,21 | 12,07 | 12,41 | 11,85 |

| USD/PLN exchange rate per the NBP | 3,6117 | 3,7782 | (4,4) | 3,7671 | 3,7018 | 3,5778 | 3,4009 | |

| USD/CAD exchange rate per the Bank of Canada | 1,2957 | 1,2986 | (0,2) | 1,3204 | 1,3070 | 1,2911 | 1,2647 | |

| USD/CLP exchange rate per the Bank of Chile | 640 | 649 | (1,4) | 679 | 662 | 621 | 602 |

KGHM Group and Our World

Analysis of the global market for the Group’s primary products

The primary products of the KGHM Polska Miedź S.A. Group, i.e. copper concentrates, cathodes, copper wire rod and silver in the form of bars and grains are traded on the highly-competitive global market as well as in reference to the commodity markets. Individual markets for the products offered by KGHM have varied rules and customs concerning trading and standard prices. Their incomparability is also due to the characteristics of individual products, which impacts their usage and the diversification of market participants.

Copper

The primary copper products offered by the companies of the KGHM Group are concentrates, cathodes and copper wire rod. They are products of individual stages of copper ore processing. For all of these products, the price benchmark (i.e. the global benchmark of copper prices for physical sales contracts of copper-bearing materials and products) is stock quotations, with the cash settlement of the London Metal Exchange (LME) being most commonly used. Less commonly used are alternative quotations of copper on stock exchanges in New York (COMEX) and Shanghai (Shanghai Futures Exchange). Grade “A” type, with a copper content of at least 99.99% (standard BS:EN 1978:1998 - Cu-CATH-1) are quoted on the LME. In order to be able to apply stock exchange prices to purchase/sale transactions of the products to which this quality standard is not applicable (i.e. all types of copper-bearing materials like copper concentrates, copper scrap or more processed products like copper wire rod), market participants have developed a premium and discount system, which adjusts stock quotations. It allows setting of a market price for a product which takes into account its processing stage, its physical state and chemical makeup, as well as costs of insurance and transport to an agreed delivery destination and the current availability of the metal in a given location.

Copper concentrates

Copper concentrate is a product made by processing copper ore, which usually has a relatively low metal content and is not suitable for direct metallurgical processing. Usually, copper content in concentrate varies from percentages in the teens to several tens percent, which enables further processing in copper smelters and refineries. The cost of transporting products with a lower copper content basically eliminates them from trade in the global market (with certain exceptions), therefore it may be assumed that copper concentrate is the first product of processing copper ore that may be generally traded. The main participants of the concentrate markets are mines supplying the product on the market and smelters and refineries, for which the concentrates are materials for production. As a result of metallurgical processes copper is produced as well as the by-products of processing (mainly precious metals, sulphuric acid, lead etc). Trading companies intermediating in the purchase/sale transactions and offering additional services expected by the parties also play a significant role on this international market. In 2018, the total global production of copper in Cu concentrate is estimated at 16.8 million tonnes (according to CRU).

Geographical breakdown of copper concentrates production in 2018

Source: CRU, KGHM Polska Miedź S.A.

Geographical breakdown of copper blister production from copper concentrates in 2018

Source: CRU, KGHM Polska Miedź S.A.

Copper concentrates require processing into refined copper, which leads to incurring processing costs and the incomplete recovery of metals in individual production stages. Therefore, the transaction price should have a set of discounts as compared to quoted prices for refined copper. The benchmark of these discounts (for TC/RC) is determined during negotiations with the main producers of concentrates (Freeport McMoRan, Antofagasta) and their customers (mainly Chinese and Japanese smelters and refineries).

Companies of the KGHM Group participate in the copper concentrate markets mainly by selling concentrate from Sierra Gorda in Chile and from Robinson in the USA. Occasionally, KGHM Polska Miedź S.A. also sells copper concentrate produced by the Lubin, Rudna and Polkowice-Sieroszowice mines. At the same time the Company purchases copper concentrates from the market with characteristics suitable for more efficient utilisation of the production capabilities of the smelters and refineries in Poland.

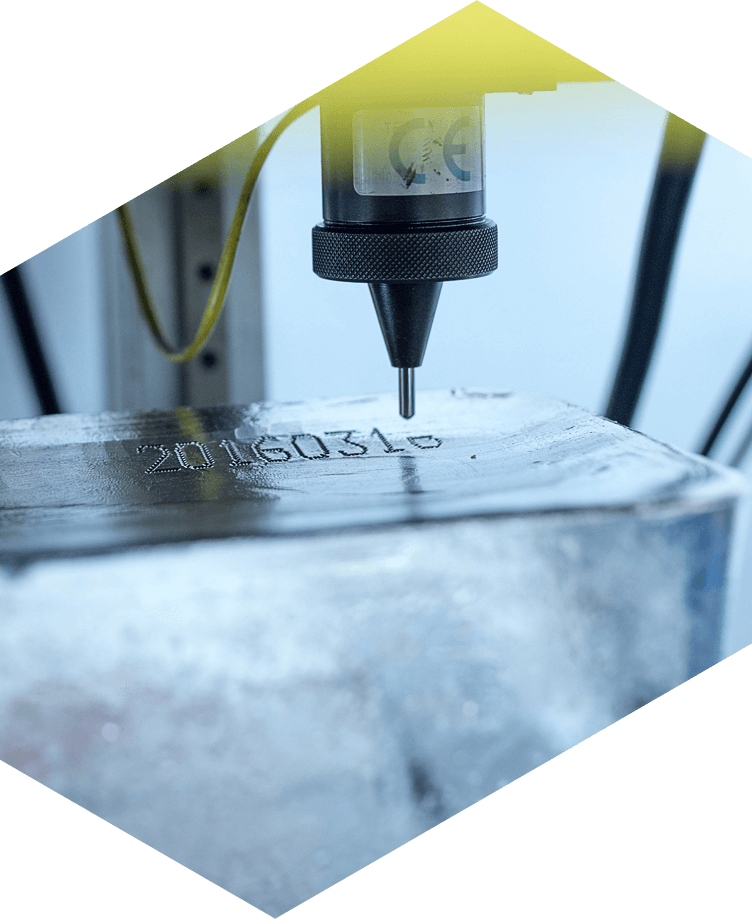

Copper cathodes

Refined copper in the form of copper cathodes is the end product of the smelting and refining processes, to which the copper-bearing materials are subjected (including concentrates, copper blister, anodes and copper scrap). Primary commodities exchanges (including the LME and SHFE) enable cathodes to be registered (Grade A type, with a copper content of at least 99.99% under the BS:EN 1978:1998 - Cu-CATH-1 standard), and therefore their trading on exchanges and through LME-approved warehouses. The copper cathodes produced by KGHM are registered on the LME as well as on SHFE, under the brands: HML, HMG-B and HMG-S. Unregistered cathodes are also traded on the physical market (for example those that do not meet quality parameters or the minimal yearly production conditions set by exchanges). One example of unregistered cathodes produced by KGHM are those from Carlota and Franke mines. The main participants in the cathodes market are mining and smelting companies producing copper in the form of cathodes and wire rod plants and other companies engaged in copper processing, which use cathodes to produce wire rod, other rods, flat bars, pipes, sheets and belts. Trading companies and financial institutions intermediating in the cathodes trade are also important participants in the market. In 2018, total global production of refined copper is estimated by CRU at 23.8 million tonnes.

Geographical breakdown of refined copper production in 2018

Source: CRU, KGHM Polska Miedź S.A.

Geographical breakdown of refined copper consumption in 2018

Source: CRU, KGHM Polska Miedź S.A.

It is a standard practice on the Grade “A” copper cathodes market to add a producer’s premium to the prices set by global exchanges. Its level allows the producer to cover the cost of transport and insurance to the agreed delivery destination, and it also includes the premium for quality (of a given cathodes brand) and supply-demand situation on a given market.

The companies of the KGHM Group participate on the cathodes market mainly by selling cathodes from the Group’s Polish assets. The Głogów Copper Smelter and Refinery produces cathodes of the HMG-S and HMG-B brands, while the Legnica Copper Smelter and Refinery produces cathodes of the HML brand. Moreover, the KGHM Group offers cathodes produced through the leaching and electrowinning process (SX/EW) in the Franke mine in Chile and in the Carlota mine in the United States. Production of refined copper in the companies of the KGHM Group amounted to 525.2 thousand tonnes, which represents approx. 2.2% of global production.

Copper wire rod

Copper wire rod is manufactured in the continuous process of melting, casting and drawing in plants processing refined copper in the form of cathodes (although higher-grade copper scrap may also be used). Wire rod is a half-finished product used in the production of single wires and multiple wires used to produce conducting vines in cables and electric cables (for example: enamelled cable, car cables, power cords etc.). Similarly as for copper cathodes, trading companies are also involved in the physical trading of copper wire rod, apart from companies with wire rod plants and cable-producing companies. The wire rod market, due to the quality characteristics of the product, is more of a local market than the cathodes or copper concentrate markets. In 2018, total global production of copper in the form of wire rod is estimated by CRU at 18.3 million tonnes.

Geographical breakdown of copper wire rod production in 2018

Source: CRU, KGHM Polska Miedź S.A.

Geographical breakdown of global wire rod consumption in 2018

Source: CRU, KGHM Polska Miedź S.A.

Wire rod’s price structure, apart from the copper quotations on the London Metals Exchange, also includes a producer’s fee (added to cathodes) and the refining charges due to the costs of processing cathodes into wire rod. KGHM produces wire rod in the Cedynia Wire Rod Plant in Orsk.

Silver

Approx. 75% of global metallic silver production is a by-product of mining ores of other metals. Silver, due to its unique physical characteristics, is used in the jewellery, electronics and electrical industries, as well as in medicine, optics, the energy industry, the automotive industry and many others. In total, industry utilises approx. 40% of global silver production. It is also a valued investment metal. According to CRU estimates, in 2018 global production of mined silver amounted to 26.7 thousand tonnes.

Geographical breakdown of global mined silver production in 2018

Source: CRU, KGHM Polska Miedź S.A.

Geographical breakdown of global silver consumption in 2018

Source: CRU, KGHM Polska Miedź S.A.

Usually, participants in the silver market make use of London Bullion Market Association quotations when setting the price for silver in physical transactions, after adjusting for current market conditions.

KGHM sells silver in the form of bars and grains (produced at the Głogów Copper Smelter and Refinery) and is one of the largest producers of metallic silver. Yearly, the Company produces approx. 1.2 thousand tonnes of this valuable metal. Silver in the form of bars is registered under the brand KGHM HG and has a registered certificate on the New York Mercantile Exchange (NYMEX) as well as Good Delivery certificates issued by the London Bullion Market Association. Silver is supplied in the form of grains to the photographic, jewellery and metals industries, which produce alloys containing silver. Silver in the form of bars (ingots) is mainly purchased by financial institutions.

KGHM Group and Our World

Market perspective

According to analysts’ consensus, economic growth will begin to slow after 2019, along with continuing slowdown in the Eurozone, along with a deterioration of readings from the USA and China which nonetheless have recently surprised frequently to the upside. A potential slowdown, especially in China, which is the world’s largest consumer of copper, could detrimentally impact demand for most of the industrial metals in the short term.

In terms of copper supply, an increasingly important question is that of the drop in copper grade in ore (0.45% globally in 2018) and the increasing amounts of impurities. Additional producers are being forced to make substantial investments in in order to maintain production levels. Some large open-pit mines, such as Grasberg and Chuquicamata, are being transformed into underground mines, which also plays a part in rising production costs. The market will have to deal with restrictions resulting from the underinvestment in copper mining projects in recent years, during which most of the commodities reached multi-year minimums. There has however been seen recently a reversal of the policy of many companies and an increase in investments.

In 2018 and at the start of 2019 it was difficult to notice a direct correlation between the price of copper and the market deficit, affected by the high level of inventories. If however this deficit continues, there should be a reaction by the copper price.

Many countries, including China, have begun to place increasing attention on the question of environmental protection. In many Chinese provinces, industrial production during the winter months is officially restricted in order to fight smog. Further regulations and requirements are being introduced, although not all metallurgical plants meet the requirements introduced back in 2013. China is currently advancing a program called „National Sword”, which was approved by President Xi Jinping and national customs offices aimed at restricting the inflow of imported wastes. The Chinese plan to replace the decrease in imported scrap caused by the new regulations by a rapid rise in domestic production. This could have a serious impact on international scrap flows and could lead to higher demand for copper concentrate.

These events reflect the trend towards green technology and renewable energy sources. The rapidly growing electric car sector could potentially result in a significant rise in demand for copper (the amount of copper in electric vehicles is up to four times as much as in conventional combustion engines) as well as for many other metals. The batteries produced using NMC and NCA nickel-containing technology, which are used in EV production, have outstanding electro-chemical properties. Demand for nickel from this sector by 2025, as estimated by the leading financial institutions, will exceed 200 thousand tonnes, or approx. 10% of total demand recorded in recent years. The diversification of energy portfolios and increases in the use of renewable energy sources which many countries have been promoting has lead to a substantial increase in demand for wind farms, which has had a positive impact on copper consumption. On the other hand the use of photovoltaics potentially supports demand for silver. The Silver Institute expects this trend to continue in the coming years, accompanied by a decrease in the amount of silver used in solar cells.

Among the threats facing this relatively favourable macroeconomic picture are further escalation in the trade conflict between the USA and China and its expansion to other regions of the globe, leading to a drop in international trade. Another risk to continued growth is the potential tightening in monetary policy and a decrease in the US Fed balance along with similar actions by other central banks around the world. This is shown in detail below:

Forecasted copper market balance (kt)

The assets, capital and corporate governance system presented above, in reference to the macro- and microenvironments, enable the KGHM Polska Miedź S.A. Group to determine the means to build its value, and to further advance this process.